Date: Fri, Dec 06, 2024, 12:13 AM GMT

The cryptocurrency market continues its bullish trajectory, highlighted by Bitcoin’s (BTC) historic milestone of crossing $100,000. Alongside this, altcoins are gaining traction as BTC dominance declines, currently standing at 55.75%, down from its recent peak of 61.53%.

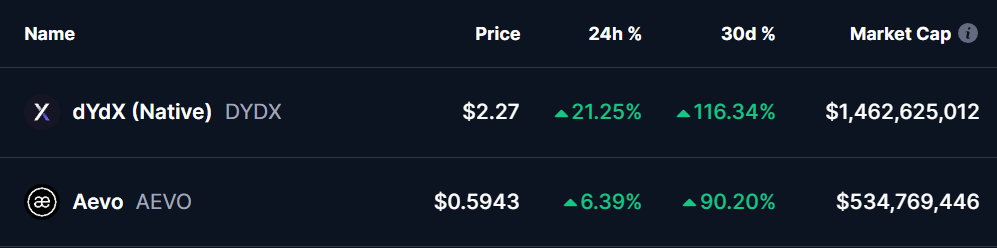

Two standout tokens, dYdX (DYDX) and Aevo (AEVO), have shown noticeable gains today, with monthly performances of 116% and 90%, respectively. However, both tokens are now approaching critical resistance levels, presenting a make-or-break scenario for traders.

dYdX (DYDX):

DYDX has captured traders’ attention with its impressive 116% rally over the past 30 days. The token has rebounded strongly from its bottom of $0.90, climbing to its current price of $2.27. This places it within a crucial resistance zone between $2.23 and $2.49, a region that has previously acted as a barrier.

A breakout above $2.49 could propel DYDX toward its next resistance at $3.74, representing a potential 50% rally from the current zone. Sustained bullish momentum might even drive prices to $4.54, offering a substantial upside opportunity.

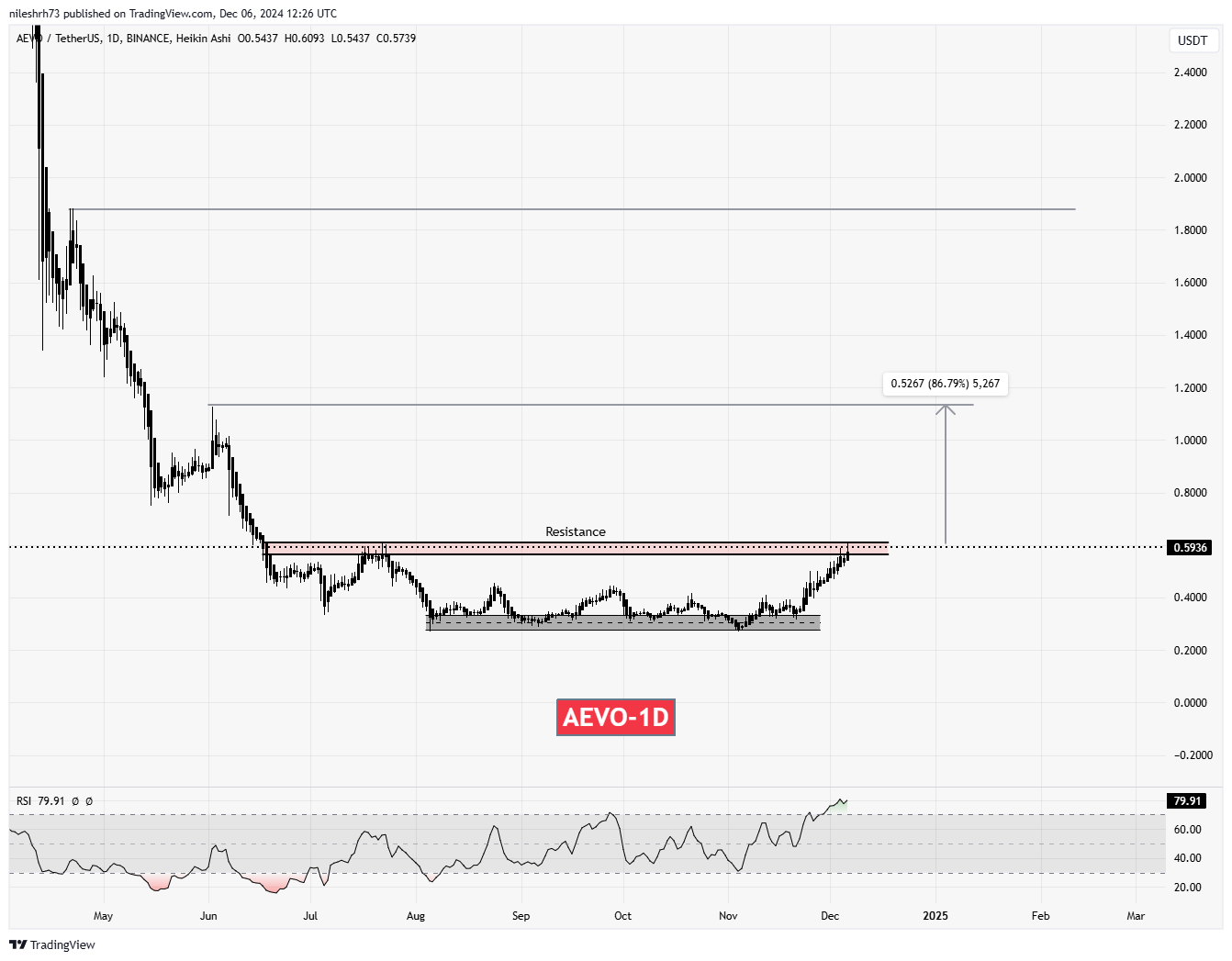

Aevo (AEVO):

AEVO has also been on a tear, surging 90% over the past month. The token has reversed from a low of $0.30 to its current level of $0.59, positioning itself within a resistance range of $0.56 to $0.61.

If AEVO breaks above $0.61, it could rally toward $1.13, offering an 86% upside from its current resistance. With strong market support, the next target could be $1.88, signaling a significant bullish continuation.

What To Expect Ahead?

Both DYDX and AEVO are positioned at pivotal resistance levels that could determine their near-term trajectories. The recent decline in Bitcoin’s dominance could further fuel altcoin performance, providing an opportunity for DYDX and AEVO to shine. However, rejection at these resistance zones could lead to short-term corrections, offering potential re-entry points for traders.

A successful breakout for DYDX above $2.49 or for AEVO above $0.61 would likely attract further buying interest, driving prices higher in the coming weeks. Traders should monitor volume and macro market conditions closely to gauge the likelihood of these breakouts.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.