/ Discover the latest insights of the crypto market today: JasmyCoin (JASMY) and SingularityNet (AGIX) tokens surging, while MYRO token goes down.

Author: Nilesh Hembade

Date: 22 Feb 2024, 10:15 AM IST

As the sun rises on Thursday morning, the crypto market showing bearish sentiments. While OG’s like Bitcoin (BTC) and Ethereum (ETH) are witnessing a dip in their prices, other altcoins such as SOL, XRP, ADA, and AVAX are also experiencing a downturn. However, amidst this bearish trend, JasmyCoin (JASMY) and SingularityNet (AGIX) stand out as bright spots, continuing their upward trajectory.

Bitcoin (BTC) and Ethereum (ETH) Prices:

Bitcoin (BTC) is currently trading at $51,453, marking a decrease of 0.79% over the last 24 hours, with its market cap standing at a formidable $1.01 trillion. Ethereum (ETH), on the other hand, has seen a 2.20% decline, settling at $2,924, with a market cap of $351 billion.

JasmyCoin (JASMY) and SingularityNet (AGIX) on the Rise:

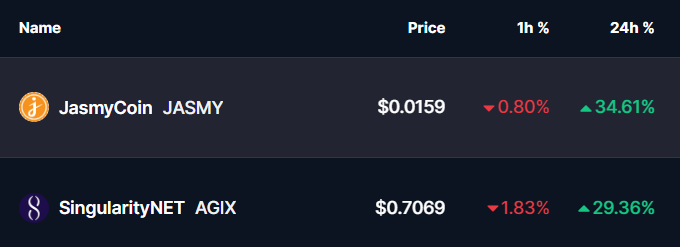

1.JasmyCoin (JASMY): The Internet of Things (IoT) token, JasmyCoin (JASMY), has demonstrated an impressive surge of 34.61%, reaching $0.0159 within the last 24 hours. With a market cap of $785 million, JASMY continues to captivate investors with its bullish momentum.

2.SingularityNet (AGIX): SingularityNet (AGIX), the Artificial Intelligence (AI) token, has also soared, experiencing a noteworthy increase of 29..36% and reaching $0.7069 in the last 24 hours. With a market cap of $872 million, AGIX showcases resilience and strength in a volatile market.

Myro (MYRO) Faces Decline:

Unfortunately, not all coins are basking in the glory of upward trends. Myro (MYRO), a trending memecoin, has witnessed a significant drop of 11.67%, plummeting to $0.07125 within the last 24 hours. Its market cap now stands at $67.13 million, highlighting the challenges faced by certain coins amidst market fluctuations.

In conclusion, while the broader crypto market may be experiencing a downturn, JasmyCoin (JASMY) and SingularityNet (AGIX) shine as beacons of growth and potential. However, investors must remain vigilant, as evidenced by the decline of Myro (MYRO)