/ Discover the latest news of crypto market: Bitcoin deeps low, while Renzo, Ordinals , and Arweave plummet highest.

Author: Nilesh Hembade

Date: 01 May 2024, 09:29 AM IST

As the sun rises on Wednesday morning, the cryptocurrency market paints a picture dominated by red hues, with altcoins and meme coins witnessing substantial declines, largely influenced by the downward movement of Bitcoin (BTC).

At present, Bitcoin (BTC) finds itself teetering on a crucial support level, oscillating between $60,600 and $61,700. Should the bulls manage a successful rebound from this critical zone, we could witness BTC surge towards the coveted $71,000 milestone. Conversely, should bearish momentum persist without finding solid support, initial downside targets rest at $57,400, followed by $52,658.

However, amidst this broader market turmoil, some tokens have experienced particularly noteworthy drops in their prices. Renzo (REZ), Ordinals (ORDI), and Arweave (AR) lead the pack as the top losers of the day.

Bitcoin (BTC) and Ethereum (ETH) Prices:

In the last 24 hours, Bitcoin (BTC) witnessed a 5.33% decline, with its price dipping to $60,236. Bitcoin’s market capitalization currently stands at a staggering $1.18 trillion. Ethereum (ETH) hasn’t been spared either, experiencing a 5.51% drop to $3,005, with a market cap of $366 billion.

Top Losers:

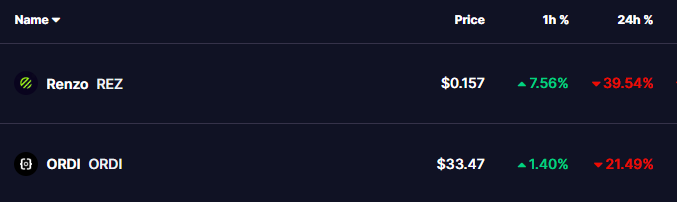

- Renzo (REZ): The newly launched Renzo (REZ) token saw a significant decrease of 39.54%, with its price plummeting to $0.1566 over the last 24 hours. Despite its recent woes, the market cap for REZ stands at $179 million.

- Ordinals (ORDI): The BRC-20 token, Ordinals (ORDI), experienced a notable decline of 21.49%, with its price falling to $33.47 in the past day. The market cap for ORDI currently stands at $703 million.

- Arweave (AR): Another casualty of the day is the DePIN token, Arweave (AR), witnessing a decrease of 16.19%, with its price dropping to $30.11 within the last 24 hours. Despite this setback, the market cap of AR stands at $1.97 billion.

As the day progresses, traders and investors will keenly monitor Bitcoin’s movement around its crucial support level, while keeping a watchful eye on how the broader market responds to these fluctuations.