Date: Fri, Dec 13, 2024, 05:51 AM GMT

The cryptocurrency market has experienced a strong bullish bounce in the past 48 hours, with altcoins showing significant recovery after earlier corrections this week. Bitcoin’s dominance has dropped to 56.18%, creating more room for altcoins to thrive.

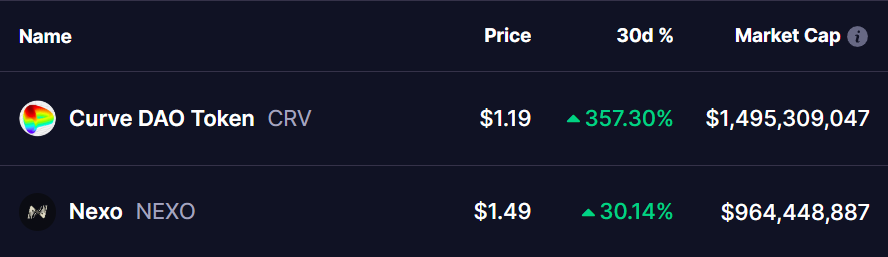

Among the standout performers are The Curve DAO Token (CRV) and Nexo (NEXO), both of which are seeing impressive rallies and could be on the verge of breaking through key resistance levels.

The Curve DAO Token (CRV):

CRV has made one of the most remarkable recoveries, climbing from a low of $0.26 to a high of $1.33 in just one month. As of now, CRV is trading at $1.19 and is testing a critical resistance zone where its descending trendline meets a horizontal resistance level.

The first important level to watch is $1.33, where a breakout could lead to a strong rally. If CRV manages to break above this level, it could target the next resistance levels at $1.60 and $2.66. This would represent a potential upside of more than 100% from the current level of $1.33.

Technical indicators are also showing positive signs. The MACD is printing green bars on the histogram, signaling growing momentum as the MACD line moves above the signal line.

Nexo (NEXO):

NEXO has also demonstrated strength, surging more than 30% over the past month. It has moved from $1.14 to its current price of $1.49. Now, it finds itself within a critical resistance zone between $1.47 and $1.60. While this range has acted as a barrier, market momentum suggests NEXO might soon attempt to break through it.

If NEXO manages to surpass the $1.60 level, it could trigger a breakout, with the next resistance at $3.20, offering a potential upside of 98% from the breakout point.

Are More Gains on the Horizon?

Both CRV and NEXO are approaching key resistance levels that could determine their next moves. With Bitcoin’s dominance on the decline, the altcoin market is seeing increased attention. If CRV breaks above $1.33 or NEXO surpasses $1.60, we could see a surge in buying interest, pushing prices higher in the weeks ahead.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before making any investment decisions.