Date: Thu, Jan 23, 2025, 06:04 AM GMT

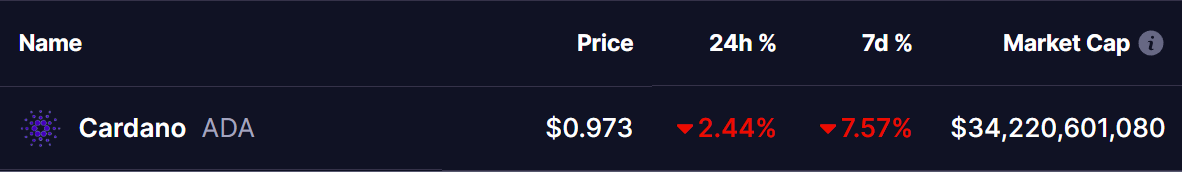

The cryptocurrency market in January has seen significant fluctuations, driven in part by rising BTC dominance. This metric has climbed from a January 4th low of 56.63% to its current level of 58.62%, prompting corrections across major altcoins, including Cardano (ADA). Over the past week, ADA has dropped over 7% amid this broader market trend, continuing its decline from the heights of its November rally.

Testing the Symmetrical Triangle’s Key Support

Between November and December 2024, ADA delivered an impressive rally, soaring by over 300% and peaking at $1.32. This rapid ascent was followed by a correction, forming a Symmetrical Triangle pattern—a consolidation structure often signaling continuation or reversal depending on the breakout direction.

Recently, ADA faced rejection near the triangle’s upper boundary at $1.16, triggering a decline toward the triangle’s critical support level. Previously, this support trendline has acted as a key rebound area, and traders are closely monitoring whether the pattern will hold.

As of now, ADA is trading at $0.97, hovering near the lower trendline of the symmetrical triangle.

Indicators to Watch: 75-Day MA and MACD

The 75-day moving average (MA) currently stands as a dynamic support level near $0.96, adding to the confluence at this key support zone. Meanwhile, the MACD (Moving Average Convergence Divergence) indicator suggests mixed momentum, with the histogram showing a slight bearish bias but flattening, signaling potential weakening of the downtrend.

Potential Scenarios

If ADA successfully holds its support level near $0.95, the price may bounce back toward the triangle’s upper resistance, estimated at $1.10. A breakout above this resistance zone could invalidate the bearish structure, paving the way for a renewed bullish rally.

However, failure to hold the current support could push ADA into deeper corrective territory, with immediate targets around $0.85–$0.90.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.