Date: Mon, March 17, 2025 | 07:18 AM GMT

The cryptocurrency market is showing early signs of recovery, with Bitcoin (BTC) rebounding from its weekly low of $76,000 to trade around $83,000. After months of steep corrections in the broader market downtrend, altcoins are beginning to break out of their bearish structures.

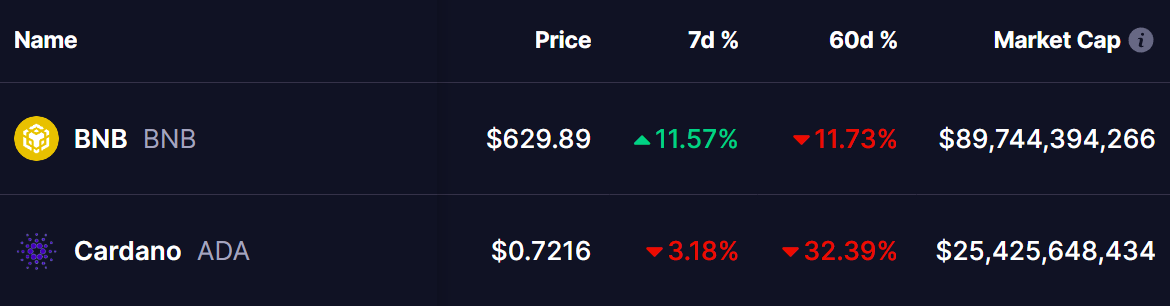

As the market stabilizes, Binance Coin (BNB) has demonstrated strong signs of a rebound, surging over 11% in the past week after bouncing from key support. Meanwhile, Cardano (ADA) is forming a similar setup, potentially mirroring BNB’s price action as it positions itself for a breakout.

Binance Coin (BNB) Analysis

BNB has been trading in a descending wedge pattern, a bullish formation that often leads to a breakout. The price previously attempted to break out of this structure, resulting in a fake-out above the wedge’s resistance before bears regained control. This led to a sharp drop, pushing the price toward the 500-day moving average (MA), which acted as strong support.

After testing this critical support level, BNB rebounded sharply, signaling renewed buying interest. The price has now climbed back toward the wedge’s upper boundary near $629, where 200-day MA (red line) is being tested.

If bulls can push BNB above this wedge’s upper trendline with a retest could signal a bullish trend reversal, with $700–$750 as the next upside target. However, failure to break out could result in another pullback, making the $524-$540 zone a crucial support level to hold.

Cardano (ADA) – Can It Follow BNB’s Path?

ADA’s price structure closely resembles BNB’s, as it has also been trading within a descending broadening wedge pattern. The altcoin saw a fake-out breakout, followed by a strong drop that pushed its price to support of the 200-day MA at the current price of $0.72.

From here, if ADA follows a similar path to BNB, where BNB made a significant jump from its 500-day MA, then ADA could see a bounce back to the 100-day MA and the upper resistance trendline of the wedge around $0.90.

In the case of a breakout with a successful retest, it would confirm a trend reversal, setting up ADA for a move toward $1.17–$1.32 as the next upside target.

Final Thoughts

BNB and ADA are both showing signs of a potential trend reversal after bouncing from key moving averages. BNB has already made a strong recovery and is now testing a critical resistance level. A successful breakout could confirm a bullish reversal and open the door for further upside.

Similarly, ADA has found support at a key moving average and is following a similar price structure. If it continues on this path, a move toward the upper resistance of the wedge is likely. A breakout and retest at this level would further validate a trend shift and signal the start of a recovery.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.