Key Highlights

- Macro Catalyst: U.S. CPI data released Jan 13 cooled to 2.7% YoY, easing inflation fears and boosting “risk-on” sentiment for Bitcoin heading into mid-2026.

- Massive Whale Accumulation: Major exchanges and insiders have stacked over 71,000 BTC (~$6.45B) in recent sessions, with Binance and Coinbase leading the aggressive buy-side pressure.

- Technical Breakout: BTC has decisively cleared the $94,773 resistance of a massive Ascending Triangle pattern, flipping a long-term hurdle into a support zone.

- The $108K Target: Based on the “measured move” of the current triangle formation, the next major technical objective sits at $108,000, provided the $95K–$97K region holds on a retest.

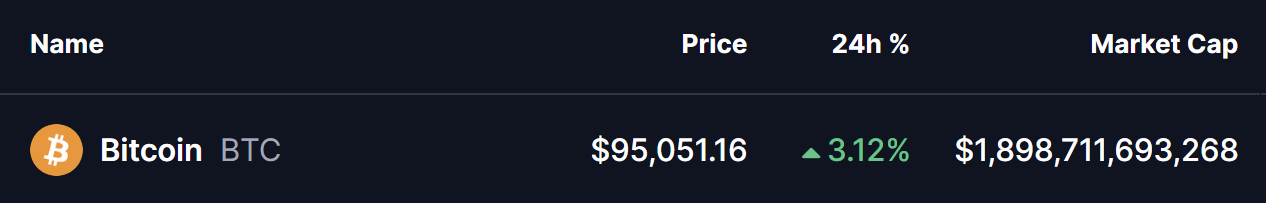

Bitcoin (BTC) is showing renewed strength on January 14, 2026, surging to a local high of around $96,495 after breaking out from key resistance levels. The asset is currently trading near $95,000, marking a solid ~3% gain in recent sessions amid broader market optimism. This rally follows the release of softer-than-feared U.S. inflation data and signs of aggressive accumulation by large players, fueling speculation about a push toward higher target like $108K.

CPI Data Sparks Risk-On Sentiment

The U.S. Bureau of Labor Statistics released the December 2025 Consumer Price Index (CPI) on January 13, 2026. The headline CPI rose 0.3% month-over-month on a seasonally adjusted basis, with the 12-month increase at around 2.7% (in line with or cooler than some expectations amid ongoing tariff and economic pressures). Core CPI (excluding food and energy) climbed 0.2% monthly, up 2.6% year-over-year.

This print eased concerns about persistent inflation, boosting hopes for a dovish Federal Reserve stance in 2026 — potentially lower borrowing costs and more favorable conditions for risk assets like cryptocurrencies. The cooler data triggered a broad risk-on mood, with BTC benefiting alongside equities as investors rotated into higher-yield opportunities.

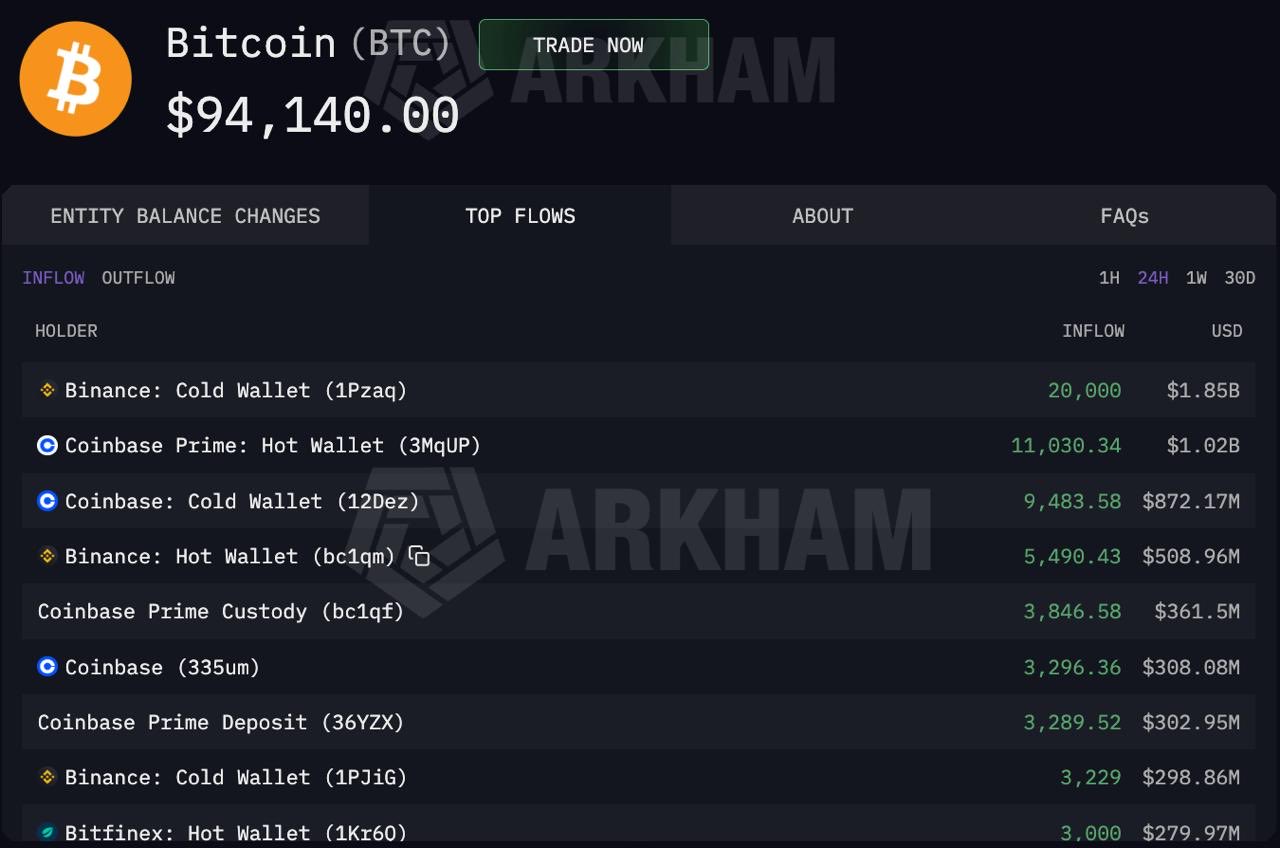

Heavy $BTC Accumulation:

On-chain metrics reveal aggressive buying by major exchanges and whales, creating significant supply pressure and supporting the upside momentum.Large players have been stacking BTC heavily:

- Binance: ~27,371 BTC accumulated

- Coinbase: ~22,892 BTC

- Kraken: ~3,508 BTC

- Bitfinex: ~3,000 BTC

- Insiders and whales: ~14,188 BTC

In total, this represents nearly $6 billion worth of Bitcoin accumulated in recent periods, highlighting strong conviction from deep-pocketed participants such as institutions, exchanges (often holding on behalf of clients), and high-net-worth entities. This accumulation contrasts with spot Bitcoin ETFs, which recorded $870 million in inflows last week, providing steady downside support.

Technical Breakout in Bitcoin (BTC)

The daily chart shows Bitcoin breaking out of an ascending triangle pattern — a bullish continuation formation characterized by higher lows and a flat upper resistance.

- The breakout occurred around $94,773, propelling BTC to the recent local high of $96,418.

- Price is now eyeing the 100-day moving average (MA) near $97,455 as the next immediate hurdle.

- A potential retest of breakout levels (around the green consolidation zone) could provide healthy support before any further upside.

- If momentum holds, the measured move from the ascending triangle projects toward the $108K target (dotted line on the chart).

What’s Next for Bitcoin (BTC)?

This combination — macro relief from softer CPI, heavy on-chain accumulation, and a clean technical breakout — creates a compelling bullish narrative. A sustained hold above $95K–$97K could open the door to $100K+ psychological resistance first, with $108K as a realistic measured target in the coming weeks/months if catalysts align.

Frequently Asked Questions (FAQ)

Why is Bitcoin (BTC) pumping today?

BTC is surging due to a combination of soft U.S. CPI data (2.7% YoY), which has fueled hopes for a Fed rate cut, and massive $6 billion on-chain accumulation by exchanges like Binance and Coinbase.

What is the $108K Bitcoin price target?

The $108,000 target is a “measured move” derived from a breakout of an ascending triangle pattern on the daily chart. Technical analysts see this as the next major resistance after the $100K psychological barrier.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.