Key Takeaways

- Bitcoin has dropped to $60,000–$64,000, marking multi-month lows and a 30% monthly decline.

- Whales and sharks sold over 81,000 BTC in just eight days, pushing their supply share to a 9-month low.

- Retail investors continue buying the dip, with shrimp wallets reaching a 20-month accumulation high.

- BTC failed to reclaim the weekly EMA ribbon, with $92K–$96K now acting as major resistance.

- The mid-to-high $60K zone is the key area to watch for short-term stabilization.

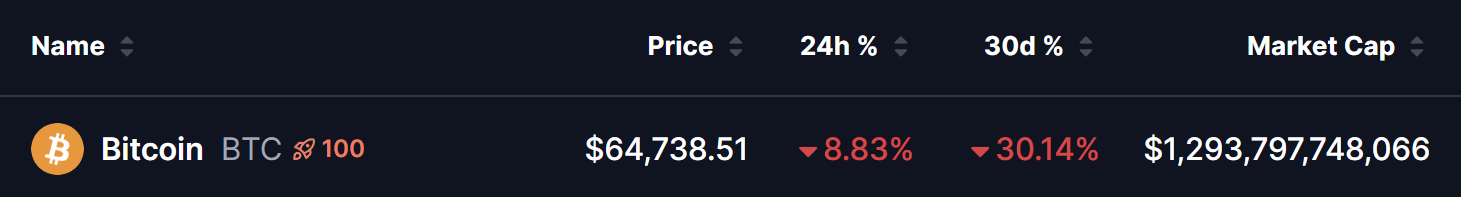

Bitcoin ($BTC) has entered a sharp correction phase to start 2026, falling to multi-month lows around $60,000–$64,000 as of February 6. The world’s largest cryptocurrency is down more than 8% in the last 24 hours and nearly 30% over the past month, pushing its market capitalization to roughly $1.29 trillion.

This drop marks Bitcoin’s weakest price levels since late 2024, wiping out a large portion of gains made during its October 2025 rally, when BTC surged above $126,000. The selloff comes amid broader market volatility, rising geopolitical uncertainty, and a noticeable shift in investor sentiment toward risk assets.

Whales Are Selling — Retail Keeps Buying the Dip

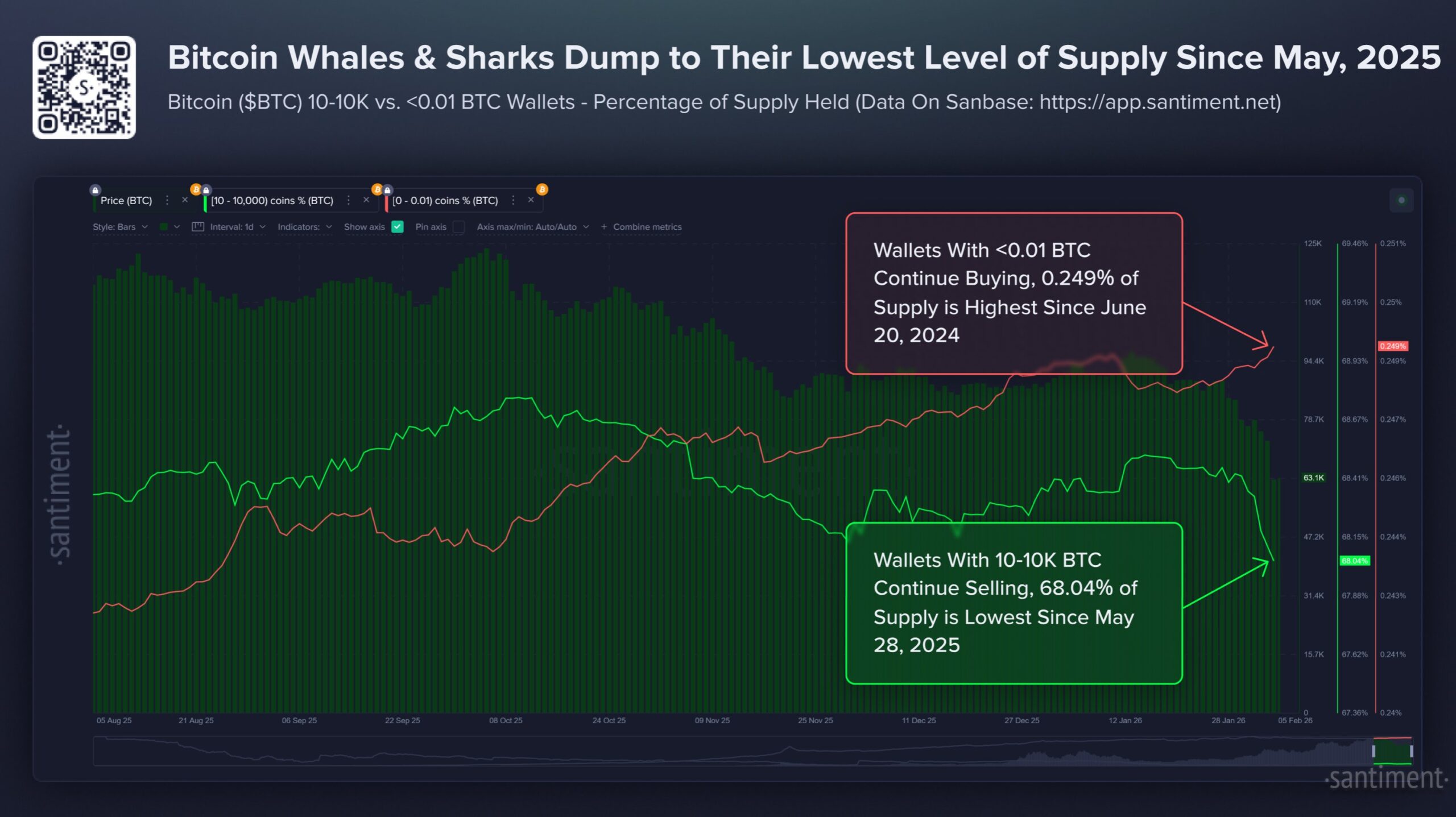

On-chain data paints a clear picture of growing divergence between large holders and everyday investors.

According to analytics platform Santiment, wallets classified as “whales” and “sharks”—those holding between 10 and 10,000 BTC—have reduced their combined share of Bitcoin’s supply to a nine-month low of 68.04%. Over just the past eight days, these large players have sold a net 81,068 BTC, signaling heavy distribution from key market participants.

Meanwhile, smaller investors are moving in the opposite direction.

So-called “shrimp” wallets (holding less than 0.01 BTC) have increased their holdings to a 20-month high, now controlling about 0.249% of the total supply. While that figure may seem small, it reflects strong retail conviction as traders continue to buy the dip despite falling prices.

Santiment analysts warn that this pattern—big money selling while retail accumulates—has historically appeared during extended bearish phases. As the firm noted:

“Until there is clear capitulation from the crowd, smart money will continue to sell and won’t feel urgency to buy back until retail interest fades.”

What’s Next for $BTC?

From a technical standpoint, the short-term outlook remains cautious.

Veteran crypto analyst Dami-Defi highlights Bitcoin’s loss of the weekly EMA ribbon, a level that has acted as a critical trend indicator in previous cycles. BTC broke below this support roughly two months ago, and recent recovery attempts were firmly rejected in the $92,000–$96,000 range—now acting as strong overhead resistance.

According to Dami-Defi, every rally into that zone should still be viewed as a selling opportunity until proven otherwise.

Looking ahead, traders are watching whether Bitcoin can stabilize in the mid-to-high $60,000 range, which could serve as a temporary base. Holding this area may lead to a capitulation phase followed by sideways consolidation—often a setup for longer-term accumulation.

However, failure to defend this region could open the door to deeper liquidations and further downside.

Despite the current weakness, Dami-Defi remains confident in Bitcoin’s broader cycle outlook, maintaining a long-term target of $150,000+:

“The structure is doing what it always does—wipe leverage, reset sentiment, then rebuild. We are not going anywhere.”

For now, Bitcoin appears to be in a painful but familiar reset phase—one that could ultimately lay the groundwork for the next major move.

Bottom Line

Bitcoin is going through a classic leverage reset phase, with whales distributing while retail steps in. As long as BTC remains below the weekly EMA ribbon, rallies are likely to face selling pressure. A hold above the mid-$60K region could pave the way for consolidation and accumulation, but losing this zone risks deeper downside. Despite short-term pain, long-term structure remains intact, with many analysts still eyeing $150K+ later this cycle.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.