Date: Tue, Oct 15, 2024, 03:05 PM GMT

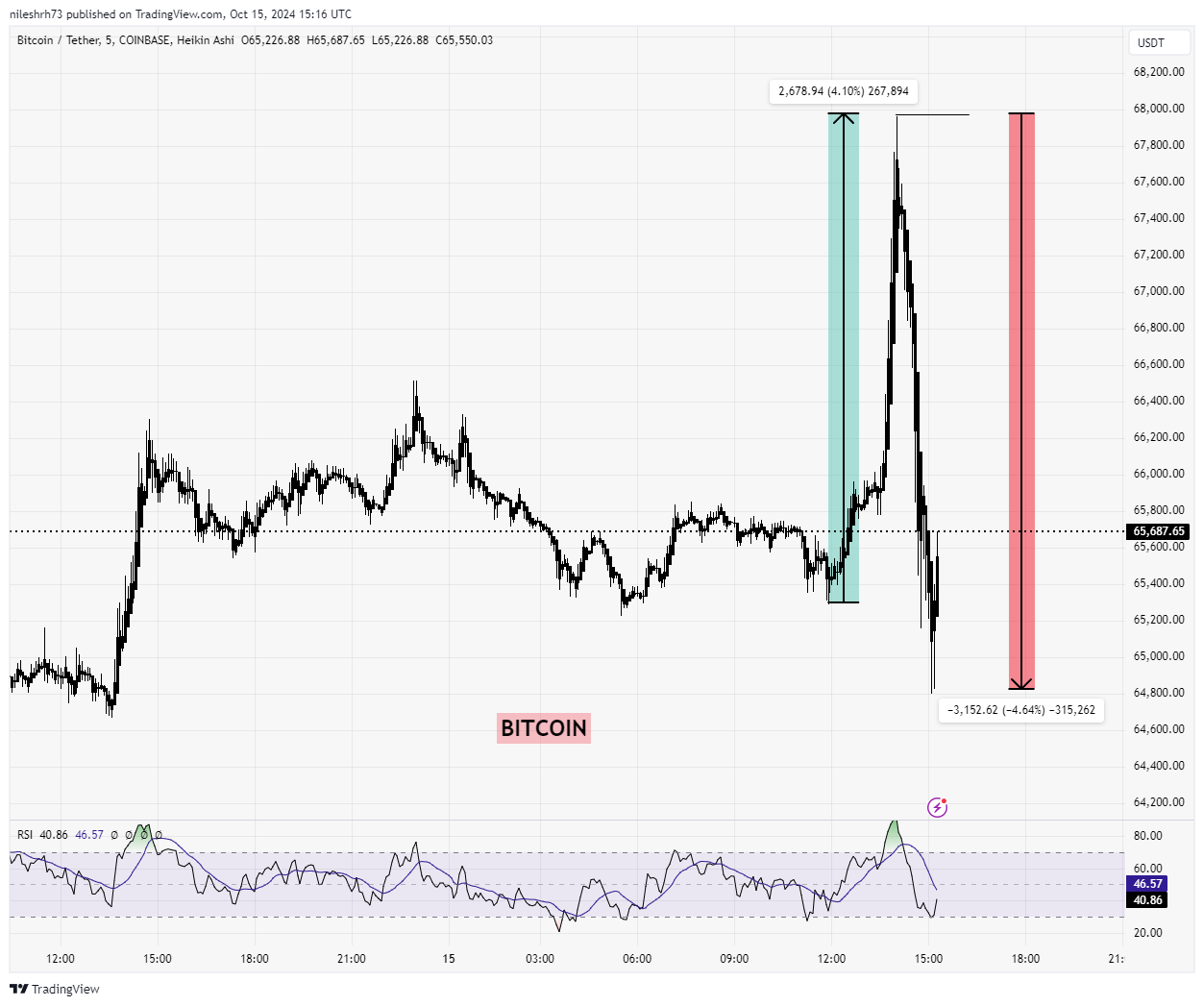

Today, the cryptocurrency market is buzzing with activity as Bitcoin (BTC) showcases significant volatility. Just within the last hour, Bitcoin surged from an initial price of $65,304 to a high of $67,962, only to quickly drop back down to around $64,800. This sharp movement has caught many traders off guard, trapping both long and short position holders.

Massive Liquidations

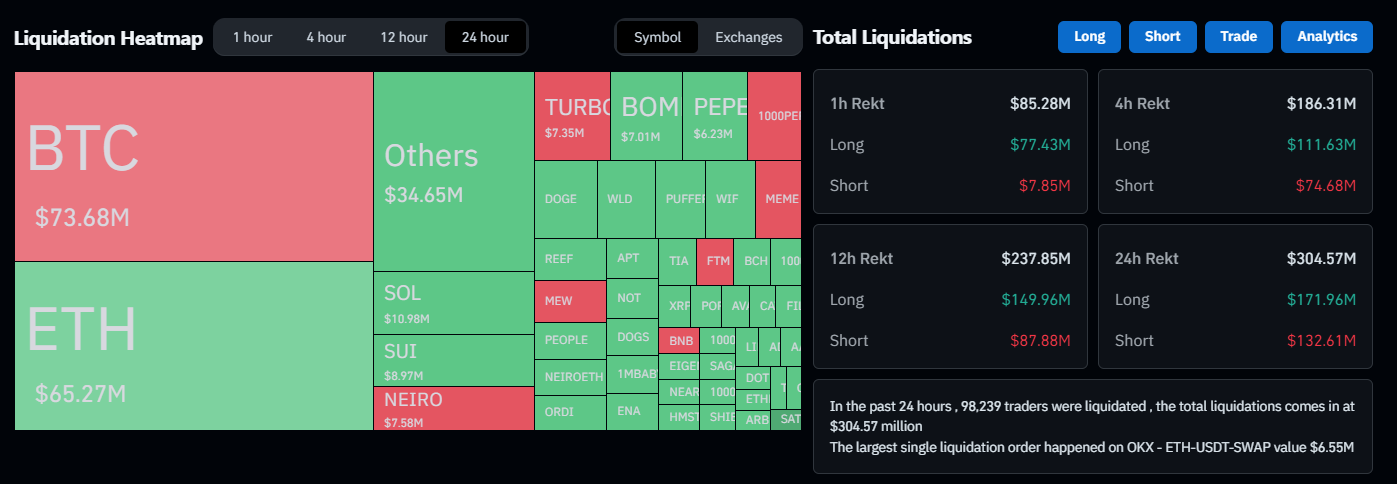

According to data from CoinGlass, over the last four hours, approximately $186 million was liquidated due to this sudden price movement. The total liquidation amount has now reached around $304 million. Among these, long position holders faced a staggering liquidation of $171 million, while short position holders experienced losses of $132 million. Notably, the most significant liquidations for short traders occurred at the $66,700 level today.

Bitcoin and Ethereum Lead Liquidations

Bitcoin was at the forefront of liquidation activity over the last 24 hours. BTC positions accounted for $73.68 million in liquidations, with $50.16 million in short positions and $23.51 million in long positions closed.

Ethereum (ETH) also saw significant liquidation volume, totaling $62.27 million. Unlike Bitcoin, Ethereum’s liquidations were more skewed towards long positions, with $45.86 million in longs and $19.41 million in shorts wiped out during the market turbulence.

The Cause of Liquidations

The sharp swings in Bitcoin’s price are a prime example of the volatility that can dominate the crypto markets. Many traders placed bets expecting Bitcoin to either continue rising or drop further, only to be caught in the sudden reversals. This unpredictability wiped out both bullish and bearish traders, forcing liquidations from both camps.

At the time of writing, Bitcoin is trading near $65,000, with traders remaining cautious as the market tries to stabilize. The rapid fluctuations serve as a reminder of the risks involved in leveraged trading and the importance of managing positions carefully in volatile environments.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.