Date: Mon, Oct 28, 2024, 04:35 PM GMT

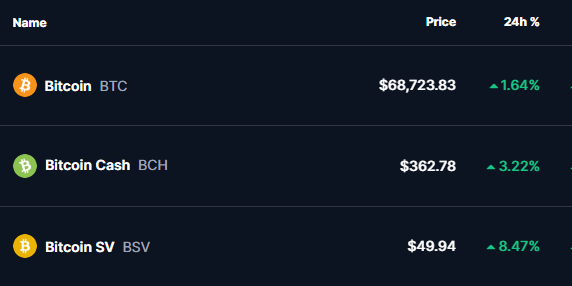

Today’s cryptocurrency market shows a strong shift in favor of Bitcoin (BTC), which is experiencing a price surge of 1.64%, reaching $68,700. While Bitcoin enjoys this upswing, the altcoin market is in a significant downtrend, showing contrasting momentum.

Despite the broader bearish sentiment among altcoins, two notable exceptions are Bitcoin Cash (BCH) and Bitcoin SV (BSV). BCH is up by 3.22%, and BSV has posted an impressive gain of 8.47% in the last 24 hours.

What is Driving the Uptrend?

Bitcoin Cash and Bitcoin SV, both Bitcoin derivatives formed through hard forks, are moving in tandem with BTC. These forks were created to address scalability and efficiency issues and retain a correlation with BTC’s market performance.

Today, BTC dominance—a metric that reflects Bitcoin’s share of the total crypto market capitalization—has broken past a significant level of 59.05%, reaching 59.73%, a 0.61% increase over the last 24 hours. This breakout in BTC dominance signals that Bitcoin is taking a more central role in the market, attracting liquidity that might otherwise flow into altcoins.

As BTC dominance climbs, Bitcoin Cash and Bitcoin SV appear to benefit indirectly due to their close association with Bitcoin. This market shift hints that as BTC strengthens, assets that share Bitcoin’s legacy may also see some upward movement, even as other altcoins struggle.

What to Expect Ahead?

According to the BTC dominance chart, the market is showing a bullish outlook with BTC dominance trending toward the next resistance level around 63%. If BTC dominance continues to rise, Bitcoin Cash and Bitcoin SV could see further gains, benefiting from the prevailing Bitcoin momentum. However, this may spell trouble for the broader altcoin market, as increased BTC dominance often results in reduced capital inflow into other altcoins, leading to further downward pressure on their prices.

While the dominance trend remains bullish for BTC-related assets, altcoin investors should keep a close eye on BTC dominance levels. A sustained rise above 63% could intensify the altcoin market’s challenges, while any retracement in BTC dominance might offer a relief rally for non-Bitcoin assets.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.