Date: Sunday, Sept 01, 2024, 06:11 AM GM

The cryptocurrency market is kicking off the new month with continued bearish momentum, echoing the downturn seen in August. Over the past 24 hours, Bitcoin (BTC) has dropped by 1.74%, currently trading at $58,165. This decline has raised concerns among traders and investors, as it could lead to significant liquidations.

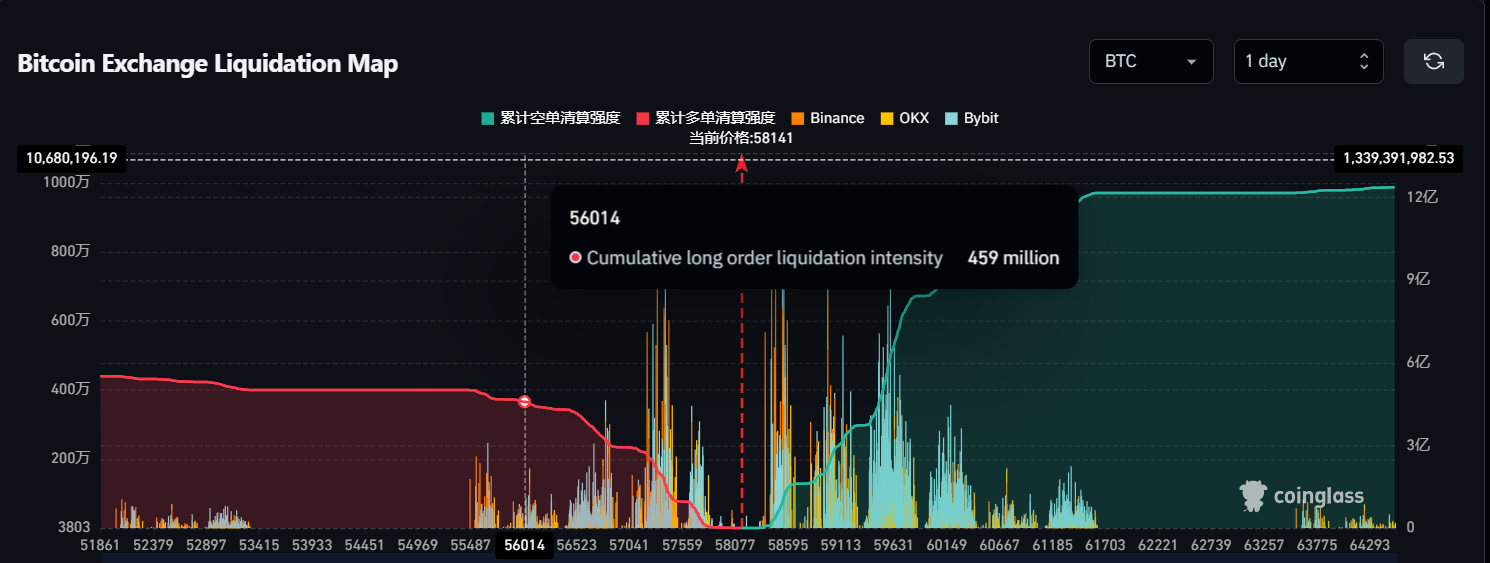

According to data from Coinglass on September 1, if Bitcoin’s price falls below $56,000, the cumulative liquidation intensity of long positions on major centralized exchanges (CEX) could reach a staggering $459 million. This means that many traders who have bet on Bitcoin’s price rising may be forced to sell their positions, amplifying the downward pressure on the market.

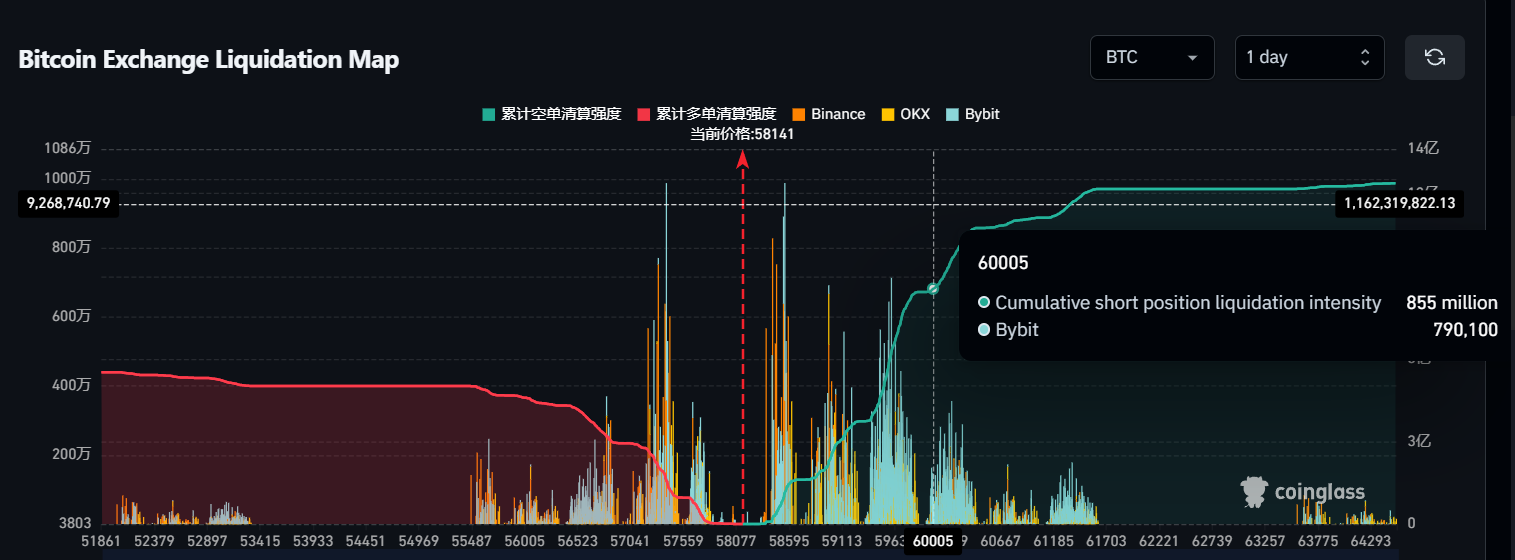

On the flip side, if Bitcoin manages to reverse its course and climbs above $60,000, the cumulative liquidation intensity of short positions on major CEX could hit $855 million. This scenario would cause a squeeze on those betting against Bitcoin, potentially driving the price higher as they scramble to cover their positions.

The market’s current bearish sentiment highlights the volatility that continues to dominate the cryptocurrency space. With large sums of money at stake, both bulls and bears are watching Bitcoin’s next move closely, as it could set the tone for the rest of the month.