Date: Thu, Jan 30, 2025, 10:34 AM GMT

The cryptocurrency market is experiencing positive momentum today as Bitcoin (BTC) surged by 2.58%, reclaiming the $105K mark. This move follows the Federal Reserve’s decision to maintain the federal funds rate at 4.25%-4.50%.

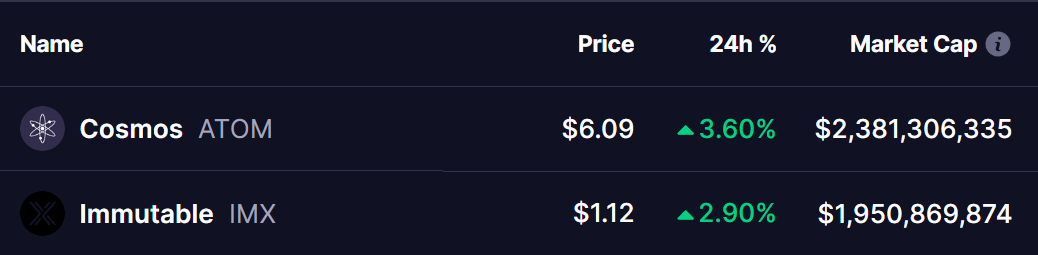

Following BTC’s lead, top altcoins including Cosmos (ATOM) and Immutable (IMX) are gaining traction, showing notable increases as they approach key resistance levels.

Cosmos (ATOM)

Currently trading at $6.09, ATOM is edging closer to a key point within a falling wedge pattern, a structure often associated with bullish reversals. The token recently found support around the $5.59 level, which coincides with the wedge’s lower boundary along with the 200SMA.

If ATOM manages to break out with a possible retest, it will face resistance at the 25SMA, and surpassing this level could push it toward the next resistance targets at $7.22 and $7.76. Such a move would represent a potential gain of up to 27% from its current price.

The MACD indicator is showing early signs of bullish momentum, with the MACD line attempting to cross above the signal line. If this trend continues, it could confirm buying pressure and support a breakout.

Immutable (IMX)

Similar to ATOM, Immutable (IMX) is steadily approaching the upper boundary of its falling wedge pattern while trading at $1.12. The token recently found support around the $1.04 level, which aligns with the wedge’s lower boundary.

If IMX manages to breach its upper resistance with a potential retest, the next resistance levels would be $1.27 and $1.43, representing gains of up to 28% from its current price.

The MACD indicator is also beginning to turn positive, suggesting a potential shift in momentum. A confirmed crossover could further strengthen the bullish case.

Are Breakouts On The Horizon?

With both ATOM and IMX nearing key resistance levels, traders should closely monitor these zones for potential breakouts. Bitcoin’s continued strength could provide further momentum for altcoins, potentially leading to extended rallies.

However, failure to break resistance could result in short-term pullbacks before another attempt at higher levels.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.