Date: Mon, Dec 08, 2025 | 05:45 AM GMT

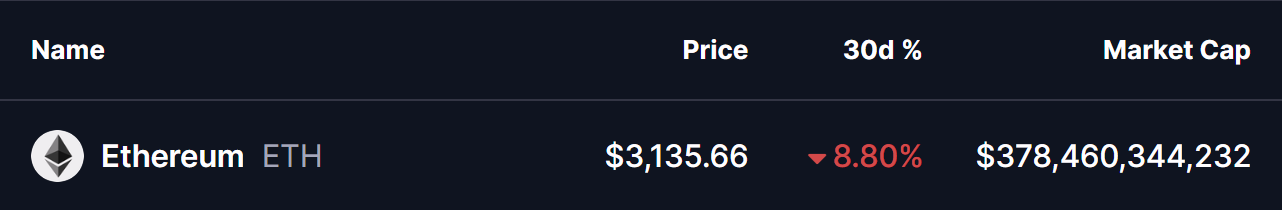

The broader altcoin market continues to battle liquidity outflows, with Ethereum (ETH) down more than 8% over the past 30 days and most mid-cap assets struggling to secure meaningful bids. Despite the weakness, the critical chart governing overall crypto capital flow—Bitcoin Dominance (BTC.D)—is now revealing a formation that could set the stage for an upcoming altcoin recovery phase.

Head and Shoulders Pattern in Play

On the 4H chart, BTC.D is developing a clear head and shoulders formation, a traditionally bearish indicator for Bitcoin dominance but one that flips bullish for altcoins if confirmed. The neckline sits around the 59.13% zone, aligning closely with the 100 moving average, making this region a decisive battleground.

BTC.D recently bounced from this neckline area and climbed back to 59.45%, completing what appears to be the right shoulder structure. Price has now eased slightly to 59.34%, showing early signs of exhaustion at the top end of the pattern. The symmetry between the shoulders and the sharp peak forming the head reinforces the validity of the setup.

If Bitcoin dominance loses its support and breaks cleanly below the neckline zone, this would signal capital rotation away from BTC and toward altcoins—one of the cleaner bullish signals alt traders look for during extended consolidation phases.

What’s Next for Altcoins?

The most crucial trigger remains the neckline breakdown. If BTC.D slips under 59.13% with sustained volume, dominance could accelerate downward toward the technical target near 58.47%. Such a drop historically correlates with relief rallies in altcoins, particularly those that have been suppressed during BTC’s recent holding pattern.

However, the right shoulder still requires completion, and bulls defending this area could delay the rotation. A bounce from the neckline could temporarily push BTC.D back toward the mid-range, pausing altcoin upside expectations.

For now, the structure signals preparation rather than confirmation. Traders anticipating altcoin strength are observing tightly, as clean head-and-shoulders breakdowns on BTC.D rarely go unnoticed in broader market positioning.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.