Key Takeaways

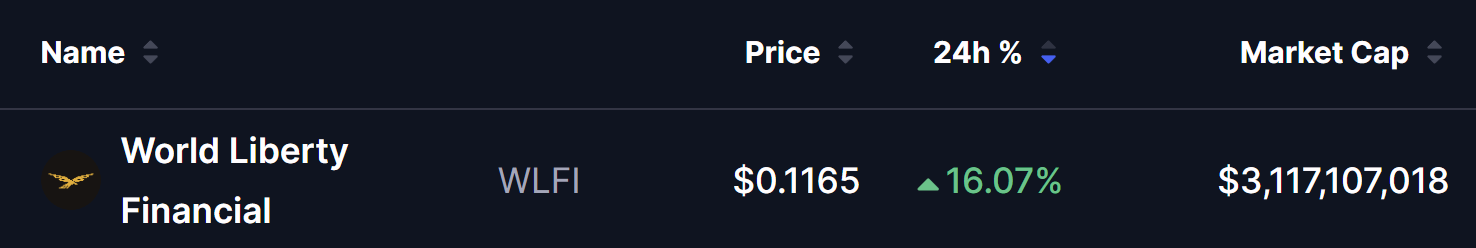

- WLFI token up 16%+ to ~$0.116, with volume surging 123% to over $245M in 24 hours — strong buying and technical bounce from $0.10 support.

- World Liberty Forum 2026 at Mar-a-Lago today is the main driver: private event with ~400 top leaders (Goldman Sachs, Nasdaq, Franklin Templeton CEOs, Nicki Minaj, regulators) focused on DeFi + TradFi.

World Liberty Financial (WLFI) is back in the spotlight today.

Backed by the Trump family and positioned at the intersection of decentralized finance (DeFi) and traditional financial systems, WLFI has surged over 16% in the past 24 hours, climbing to around $0.1165 and pushing its market capitalization beyond $3.1 billion.

Trading activity has exploded alongside the price move. WLFI recorded more than $248 million in 24-hour volume, representing a 123% jump compared to recent days — a clear sign that traders are positioning ahead of a major catalyst.

And now, with the official forum countdown ticking toward zero, urgency in the market is clearly building.

So what’s driving this sudden wave of bullish momentum?

World Liberty Forum 2026 Takes Center Stage

At the heart of WLFI’s rally is the World Liberty Forum 2026 (WLF2026), kicking off today at Mar-a-Lago.

This invitation-only event brings together roughly 400 leaders from finance, technology, policy, and entertainment. Reported attendees include executives from Goldman Sachs, Franklin Templeton, and Nasdaq — along with celebrity appearances such as Nicki Minaj.

Hosted by World Liberty Financial and closely tied to the Trump family, the forum is designed to showcase WLFI’s push into real-world finance. That includes its USD1 stablecoin and new tools like World Swap, aimed at enabling faster, lower-cost global transfers.

With the event officially underway, many traders see this as WLFI’s formal introduction to institutional finance — a moment that could reshape how traditional players engage with DeFi.

Will There Be Major Announcements?

In a word: likely.

WLFI CEO Jack Witkoff has already teased what he called a “watershed moment” for the platform. While the forum itself is closed-door, industry chatter is focused on three potential developments:

- 1. National Trust Bank License

WLFI has reportedly applied for a U.S. national trust bank license. Any update — especially approval — would allow the project to issue and custody its USD1 stablecoin under federal oversight, delivering a massive boost in credibility. - 2. Institutional Partnerships

With major exchange and asset-management leaders in attendance, rumors are swirling about possible custody agreements or TradFi integrations that could bring institutional liquidity directly into WLFI’s ecosystem. - 3. The “Super App” Reveal

The team is said to be developing a mobile “Super App” designed to make DeFi earning feel more like traditional online banking. A demo or launch timeline could easily become a classic buy-the-news moment for the market.

A Word of Caution: Buy the Rumor, Sell the News?

While momentum currently favors the bulls, it’s also worth noting that this move could turn into a classic “buy the rumor, sell the news” setup.

With expectations running high as WLF2026 unfolds, some traders may choose to lock in profits once announcements are made. That means short-term volatility shouldn’t be ruled out — even if the longer-term narrative remains compelling.

The Verdict

Whether it’s political star power, institutional curiosity, or WLFI’s ambition to strengthen U.S. dollar dominance in the digital economy, one thing is clear: World Liberty Financial has placed itself at the center of the 2026 crypto narrative.

As the forum kicks off today, the real question isn’t just how far WLFI’s price can run — it’s whether the project can truly become the bridge that connects Wall Street with DeFi.

For now, traders are watching closely. The next set of announcements could decide whether this rally fades as hype… or marks the beginning of something much bigger.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.