Key Takeaways

- $19B Liquidation Shock: The October 2025 crash wiped out over $19 billion in leveraged positions, sending Bitcoin from $120K to $102K in 24 hours.

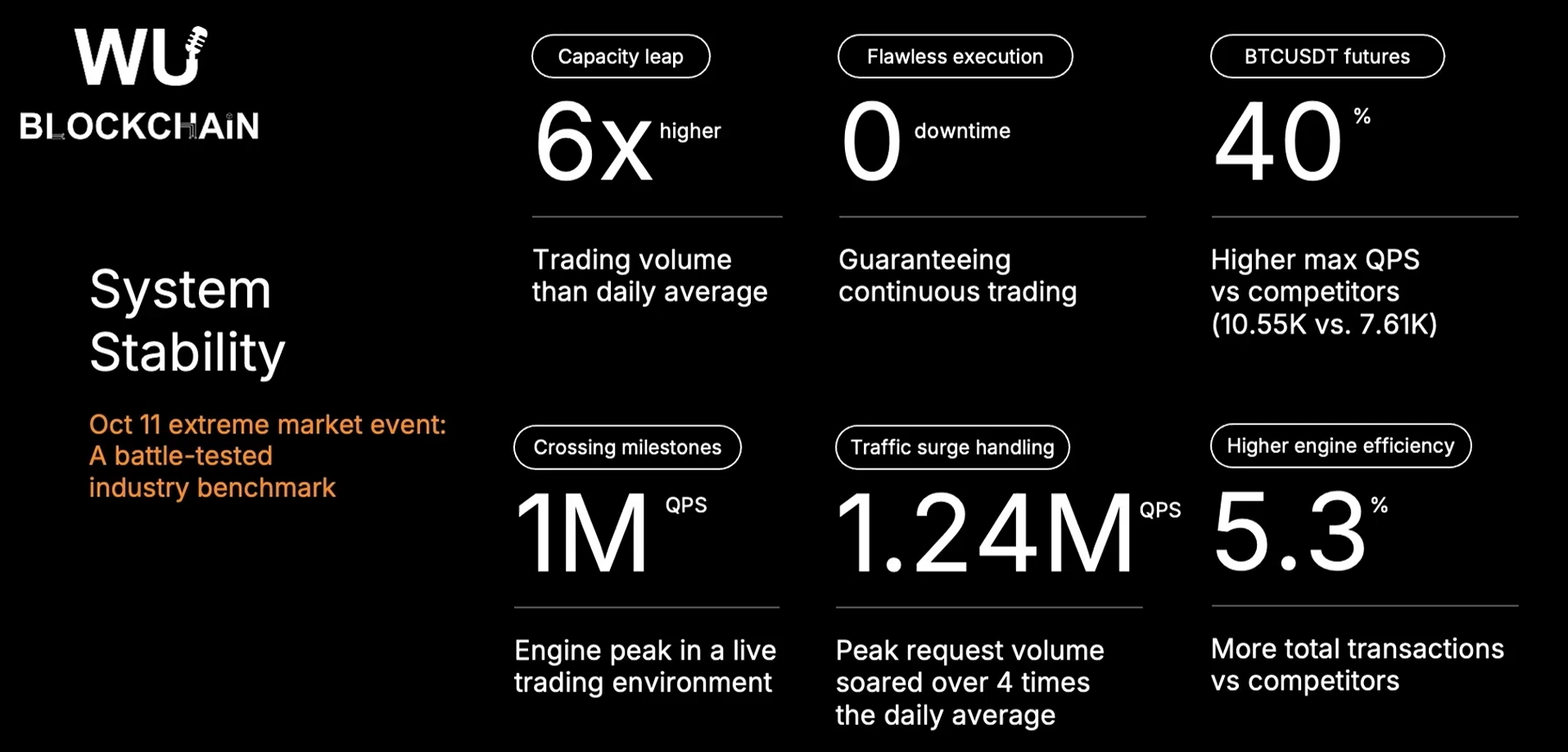

- Bybit Stayed Online: Despite extreme volatility and record traffic, Bybit reported zero downtime.

- Stronger Safeguards Added: The exchange upgraded its pricing system, launched a portfolio insurance pool, and enhanced market surveillance through new partnerships.

In the volatile world of cryptocurrency, few events have left as deep a mark as the market meltdown of October 10–11, 2025. What began as a routine trading day spiraled into the largest liquidation cascade in crypto history, erasing more than $19 billion in leveraged positions in a single 24-hour period. Bitcoin plunged from highs near $120,000 to a low of around $102,000, while altcoins like Ethereum, Solana, and smaller tokens suffered even steeper drops. The trigger? A surprise announcement from U.S. President Donald Trump imposing sweeping new tariffs on Chinese imports, reigniting trade tensions and sending risk assets into a tailspin.

Amid the chaos, one exchange stood out for its resilience: Bybit. In a recent keynote address, CEO Ben Zhou offered a candid reflection on the event—not as a moment of crisis to be glossed over, but as a pivotal learning opportunity that has since driven meaningful upgrades to the platform’s infrastructure.

A Platform That Held Firm When Others Wavered

Zhou didn’t mince words about the severity of the crash. “It shifted the entire market into a bearish trend,” he noted, acknowledging how the wave of liquidations exposed vulnerabilities across the industry. Yet Bybit itself emerged largely unscathed. The exchange reported zero downtime, even as traffic surged to over one million queries per second (QPS)—a testament to its robust backend systems and proactive engineering.

This stability wasn’t accidental. Bybit had invested heavily in scalable architecture in the years leading up to 2025, positioning itself as a reliable venue for both retail and institutional traders. But the October event served as a stress test like no other, revealing areas where even the strongest platforms could improve.

Key Upgrades: Sharper Risk Controls and Smarter Defenses

In the months following the crash, Bybit moved swiftly to address the pain points laid bare. Three major initiatives stand out:

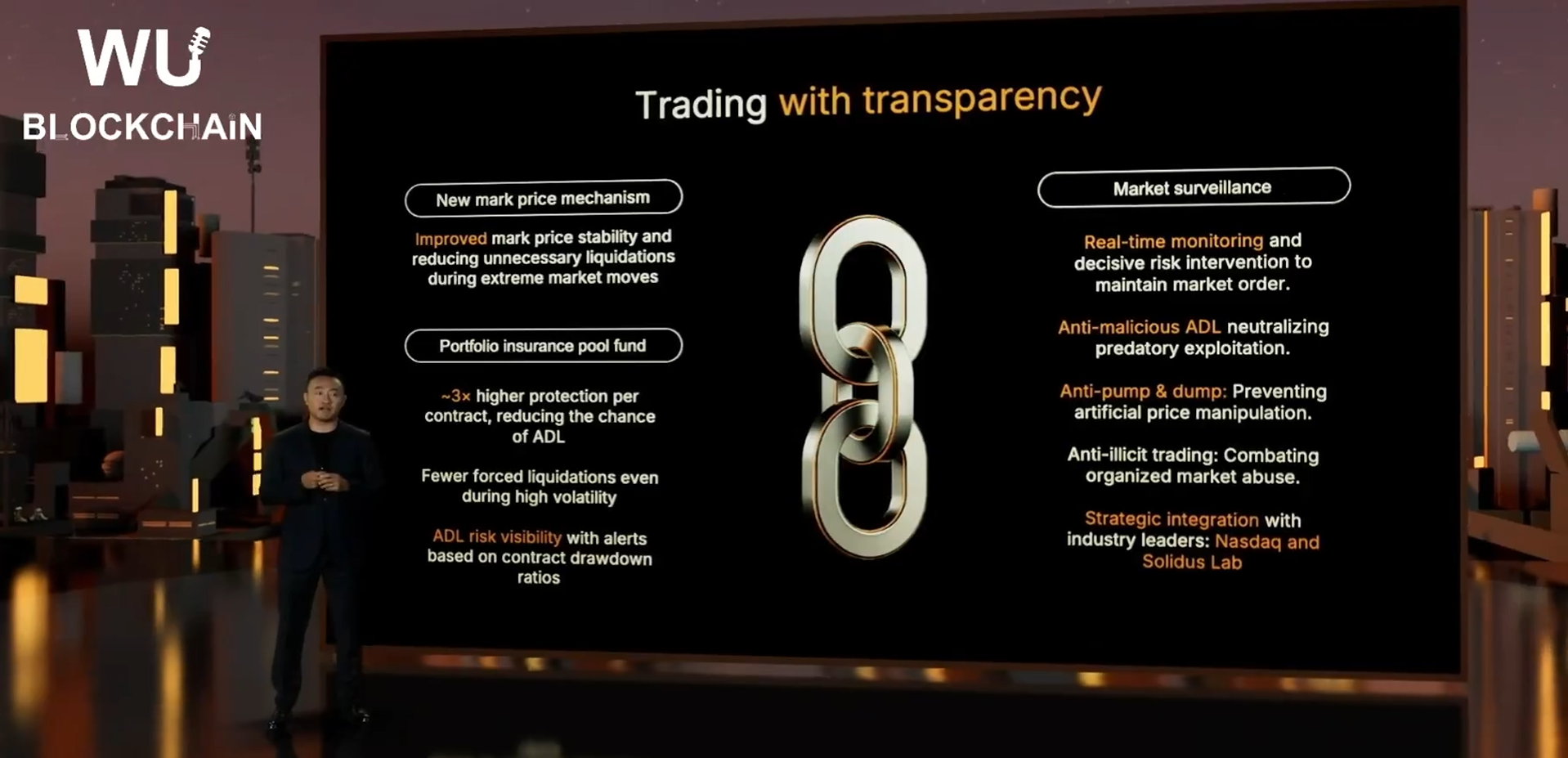

- Enhanced Mark Price Mechanism

Pricing anomalies—those sudden, artificial spikes or drops that can trigger unnecessary liquidations—were a key culprit in the October chaos. Bybit has now upgraded its mark price system with advanced filtering algorithms. The goal? To better distinguish between genuine market moves and fleeting distortions, reducing the risk of cascading liquidations during high-volatility periods. - A New Portfolio Insurance Pool

One of the most innovative responses is the introduction of a combined insurance fund for perpetual contracts. Rolled out in late 2025, this “portfolio insurance pool” groups related trading pairs based on shared liquidity and volatility profiles. By pooling resources across up to nine contracts, Bybit has boosted the average loss-absorption capacity by over 200% compared to standalone funds. The result is a significant reduction in Auto-Deleveraging (ADL) events—those dreaded moments when profitable positions are forcibly closed to cover losses elsewhere. For traders, this means greater protection during extreme conditions, with the system now far better equipped to weather the next storm. - Strategic Partnerships for Market Surveillance

Recognizing that coordinated attacks and manipulative tactics can exacerbate downturns, Bybit has deepened its defenses through collaborations with Nasdaq and Solidus Labs. These partnerships bring institutional-grade monitoring tools to the crypto space, enabling real-time detection of suspicious activity and coordinated efforts to disrupt markets. It’s a clear signal that Bybit is treating security not just as a technical challenge, but as a core pillar of user trust.

Beyond the Crash: A Blueprint for Industry Resilience

Zhou’s reflections go beyond Bybit’s own upgrades. He framed the October event as a broader wake-up call for the crypto ecosystem—one that underscores the need for better risk management, more sophisticated liquidity provisions, and stronger collaboration between exchanges, regulators, and technology providers.

In his keynote, he also touched on Bybit’s wider 2026 roadmap: from AI-driven user experiences and expanded RWA (real-world asset) offerings to deeper integration with traditional finance. But the crash response remains the emotional core—a reminder that in crypto, survival isn’t just about weathering the storm; it’s about emerging with better tools, stronger safeguards, and an unwavering focus on users.

For traders still licking their wounds from October, Zhou’s message is one of cautious optimism. “We listen, we care, we improve,” he emphasized. As the market continues its recovery—Bitcoin now trading well above the crash lows—these upgrades from Bybit could well set a new standard for how exchanges protect their communities in an increasingly complex financial landscape.

In an industry where black swans are almost seasonal, platforms like Bybit are proving that resilience isn’t about avoiding every dip—it’s about building systems that turn them into opportunities for growth.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.