Key Takeaways

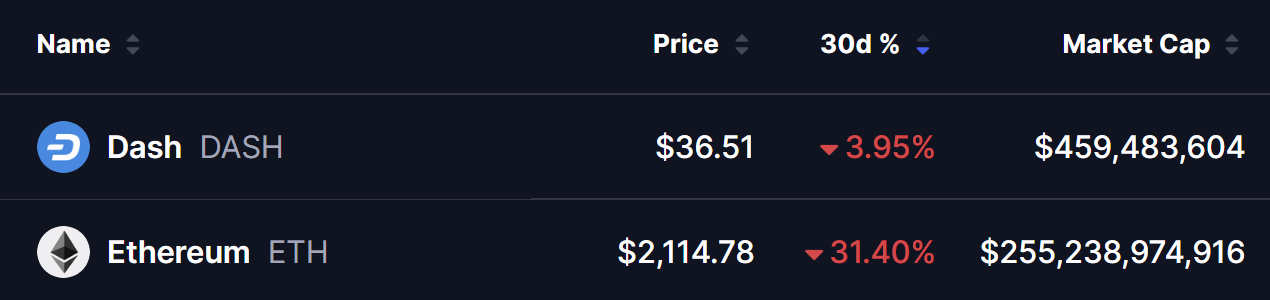

- DASH has outperformed the broader market, dropping only ~3% while ETH fell ~31%

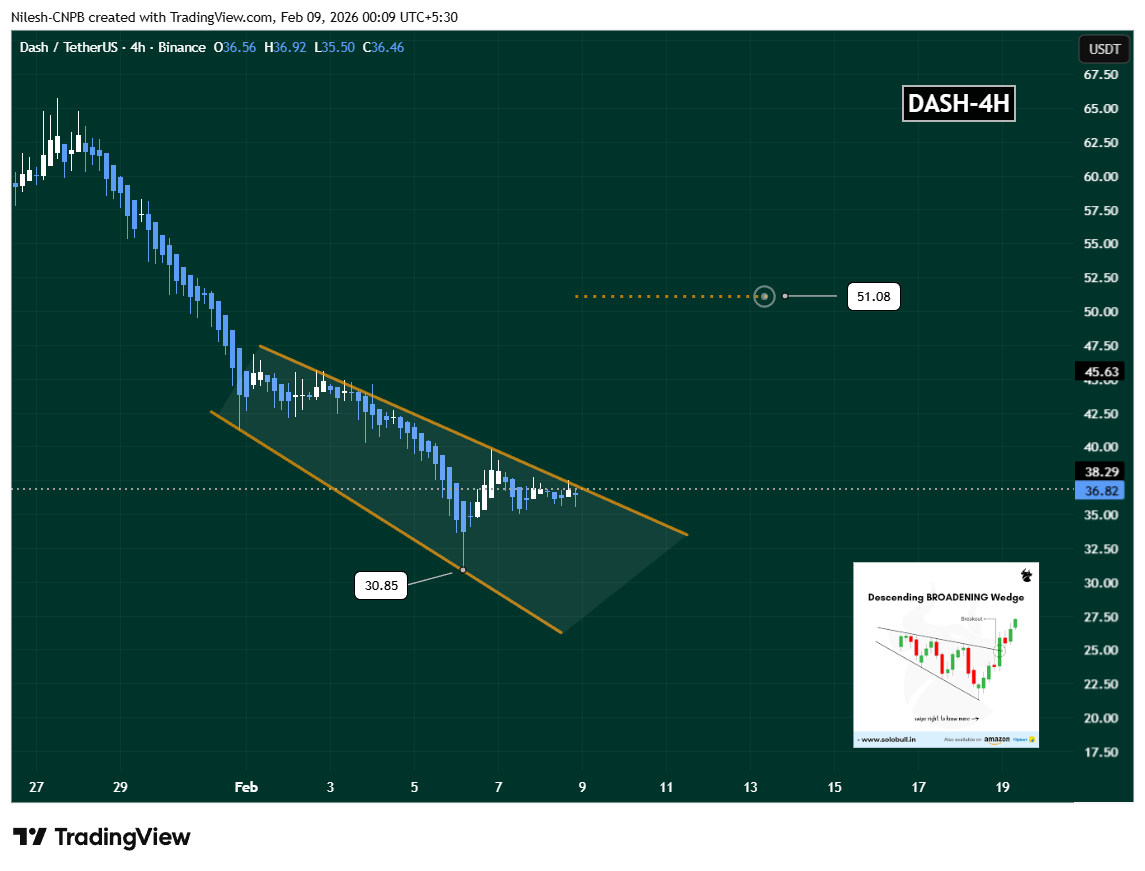

- Price is trading inside a descending broadening wedge on the 4H chart

- Strong bounce occurred from $30.85 support

- DASH is now pressing against upper wedge resistance near $36.82

- A breakout could target $51.08 (around 38% upside)

- Losing $35.01 would delay the breakout setup

DASH — the native utility token of the Dash Network, an open-source, payments-focused blockchain — has quietly shown relative strength despite the broader crypto market downturn.

While major assets like Ethereum (ETH) have dropped nearly 31% over the past 30 days, DASH has managed to hold its ground with only a modest 3% pullback during the same period.

More importantly, its current chart structure is now hinting at a potential upside breakout in the near term.

Descending Broadening Wedge Pattern in Play

On the 4-hour chart, DASH is trading inside a descending broadening wedge — a bullish reversal pattern that typically forms during corrective phases and often resolves with a breakout above the upper resistance line.

During the recent selloff, DASH successfully tested the lower wedge support near $30.85, where buyers stepped in aggressively. That level marked a clear local bottom.

Since then, price has rebounded sharply, climbing back toward $36.82, placing DASH just beneath the upper wedge boundary.

Now, price action is compressing near this descending resistance trendline — a setup that frequently precedes strong directional moves.

In simple terms: DASH is pressing against resistance, and momentum is building.

What’s Next for DASH?

If bulls manage to push price above the upper wedge resistance, it would confirm the bullish reversal pattern and could open the door for a rally toward the $51.08 region.

From current levels, that represents roughly 38% upside.

A clean breakout backed by volume would also signal a shift in short-term trend, potentially attracting momentum traders and setting the stage for DASH to outperform many large-cap altcoins.

As long as price continues to hold above recent higher lows, the structure remains constructive.

Key Risk to Watch

On the downside, failure to break resistance — followed by a move back below $35.01 — would signal weakness and could trigger a retest of the support trendline zone.

A decisive loss of that level would invalidate the bullish wedge setup and tilt the bias back in favor of sellers.

For now, however, DASH remains technically constructive, with buyers still defending key levels.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.