Key Takeaways

- Vitalik sold 2,961.5 ETH worth ~$6.6 million over the past three days at an average price of $2,228, with sales still ongoing via phased DEX transfers.

- These transactions align with his January 30, 2026 announcement, where he withdrew 16,384 ETH to personally fund open-source projects, privacy/security tools, and biotech/philanthropic efforts like Kanro.

- Amid ETH’s ~35% 30-day drop (trading ~$2,083–$2,100), the sales are strategic reallocations for ecosystem support rather than a panic dump, executed transparently to minimize market impact.

Ethereum co-founder Vitalik Buterin has sold a total of 2,961.5 ETH — valued at approximately $6.6 million — over the past three days, according to real-time on-chain monitoring. The sales, executed at an average price of around $2,228 per ETH, are reportedly still in progress as of February 5, 2026.

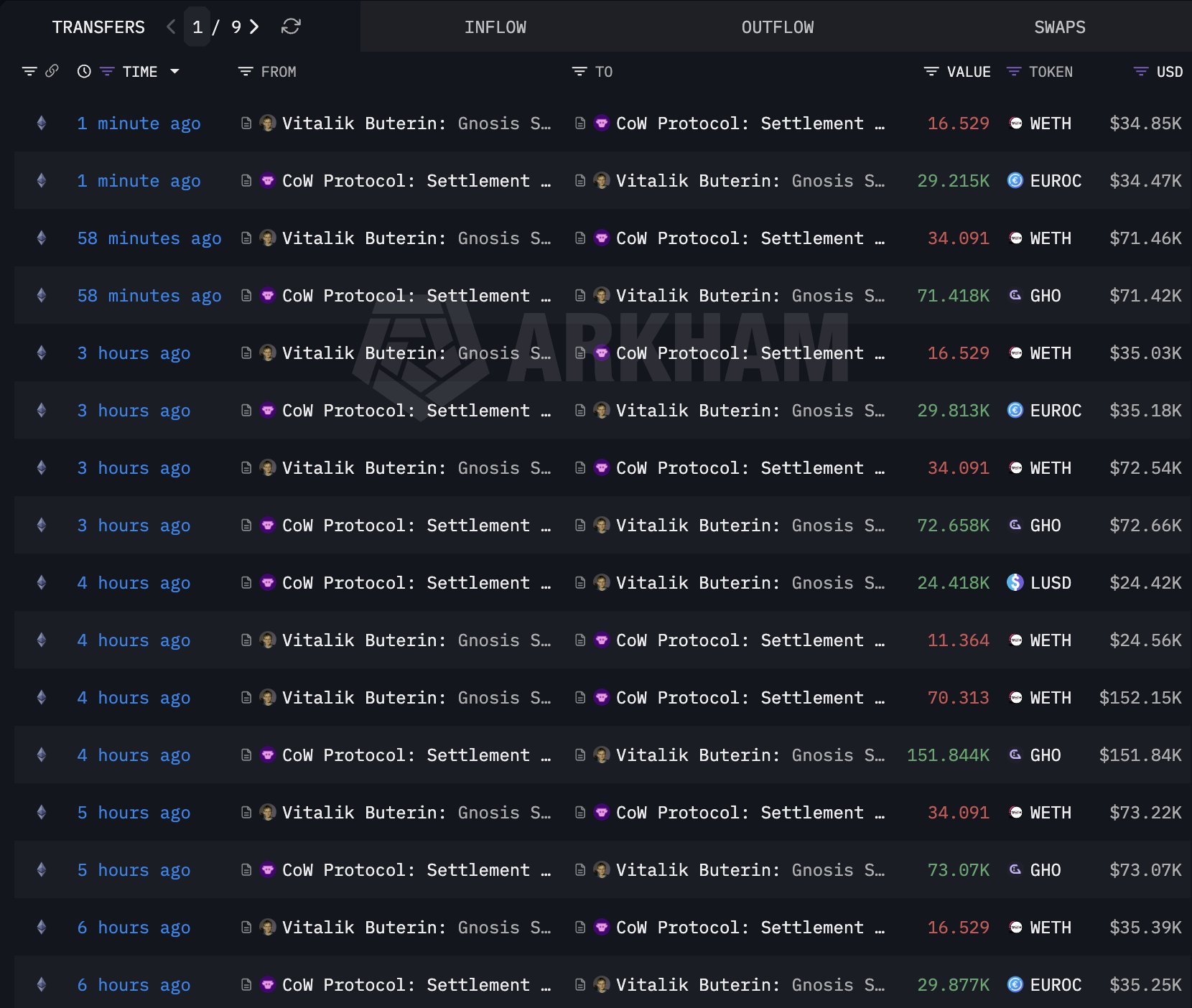

Blockchain analytics platform Lookonchain highlighted the activity in a post on X, noting: “vitalik.eth (@VitalikButerin) is dumping $ETH fast! Over the past 3 days, Vitalik has sold 2,961.5 $ETH($6.6M) at an average price of $2,228 — and the selling is still ongoing.” The transactions originate from the wallet address 0xfEB016D0D14AC0Fa6d69199608B0776d007203B2, which is publicly associated with Buterin.

This batch of sales builds on earlier reports from platforms like Onchain Lens and Lookonchain, which tracked incremental outflows earlier in the week, including conversions to stablecoins such as USDC, GHO, and WETH via decentralized protocols like CoW Swap. Recent patterns show repeated small-to-medium transfers from Buterin’s Gnosis Safe-linked wallet to settlement addresses, consistent with phased, low-impact execution.

Context: Tied to January Funding Announcement

The activity aligns directly with Buterin’s January 30, 2026, public statement on X, where he announced the withdrawal of 16,384 ETH (valued at roughly $43–45 million at the time) from his personal holdings. In that post, he explained that the funds would support a range of initiatives during the Ethereum Foundation’s period of “mild austerity,” including:

In these five years, the Ethereum Foundation is entering a period of mild austerity, in order to be able to simultaneously meet two goals:

— vitalik.eth (@VitalikButerin) January 30, 2026

1. Deliver on an aggressive roadmap that ensures Ethereum's status as a performant and scalable world computer that does not compromise on…

- Open-source, secure, and verifiable software/hardware stacks

- Privacy and security tools (e.g., ZK proofs, fully homomorphic encryption, differential privacy, encrypted messaging donations to apps like Signal and SimpleX)

- Biotech and public health efforts (explicitly referencing personal and public health applications, consistent with his Kanro philanthropic organization)

- Broader “full-stack openness and verifiability” for self-sovereignty in finance, communications, governance, and beyond

Portions of prior sales in early February (e.g., 211.84 ETH converted to $500,000 USDC) were transferred directly to Kanro, Buterin’s biotech initiative focused on pandemic preparedness, infectious disease research, and global health. Analysts view the current larger batch as a continuation of this planned reallocation rather than reactive market selling.

Market Backdrop

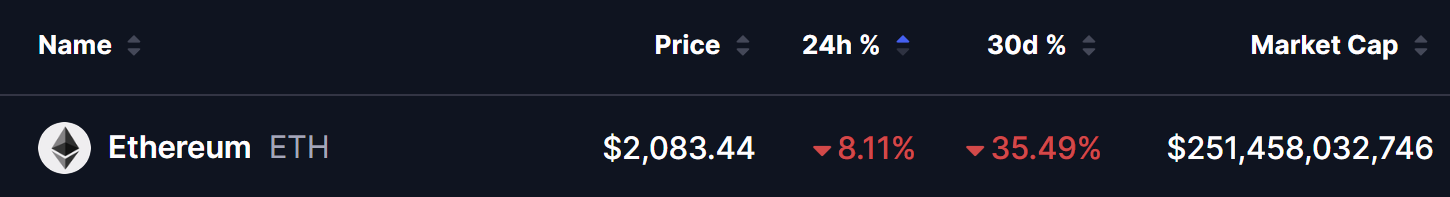

Ethereum (ETH) is trading at approximately $2,083–$2,100 as of midday February 5, 2026 (IST), reflecting an ~8% drop in the last 24 hours and a steeper ~35% decline over the past 30 days. The broader crypto market has faced pressure from macroeconomic factors, reduced inflows, and volatility, with ETH’s market cap hovering around $251 billion.

While Buterin’s sales represent a modest fraction of daily ETH volume (often exceeding $10–20 billion), the timing has amplified community discussion. Some X users and traders describe it as a “fast dump,” while others point to the transparent, gradual nature of the transactions (via DEX aggregators) as evidence of minimal intended market disruption.

These moves underscore Buterin’s shift toward personally funding Ethereum-adjacent “special projects” outside the core Ethereum Foundation roadmap — emphasizing privacy, security, biotech, and open infrastructure.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.