Key Takeaways

- Bitcoin is down 30–40% from its 2025 peak; holding $74K support is crucial to avoid a deeper move toward $70K–$73K.

- Crypto markets are under heavy pressure, with BTC around $75K–$77K and ETH down 9–10%, wiping out recent gains.

- Over $700M in liquidations hit the market in 24 hours, dominated by long positions, accelerating the sell-off.

- Risk-off sentiment is driven by U.S.–Iran tensions, a hawkish Fed outlook, and aggressive leverage unwinds.

- Ongoing ETF outflows, weak institutional demand, and macro uncertainty continue to weigh on prices.

- Bitcoin is down 30–40% from its 2025 peak; holding $74K support is crucial to avoid a deeper move toward $70K–$73K.

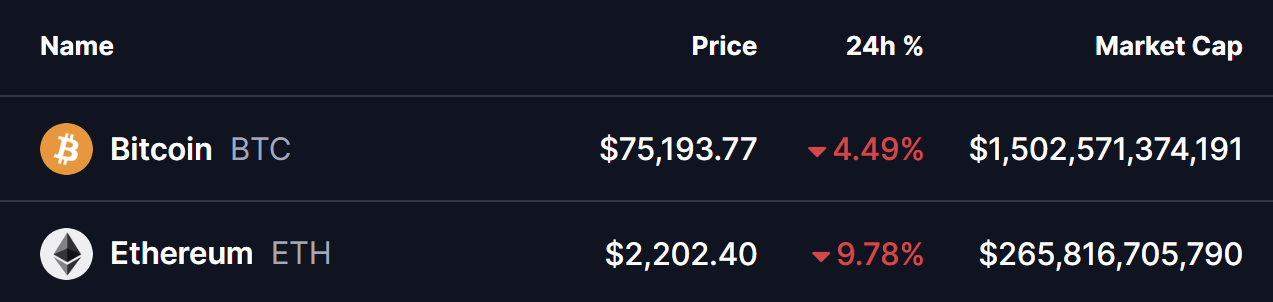

The cryptocurrency market is enduring a brutal downturn as of February 2, 2026, with Bitcoin (BTC) hovering around $75,193.77 (down 4.49% over the past 24 hours) and Ethereum (ETH) plunging to $2,202.40 (a steeper 9.78% drop).

The broader crypto space has felt intense selling pressure, evidenced by more than $706 million in total liquidations in the last day—dominated by $556 million in long positions wiped out compared to $150 million in shorts.

Key Reasons Behind Today’s Crypto Market Decline

A combination of macro, geopolitical, and technical factors has converged to fuel the drop:

- Geopolitical Tensions, Including U.S.-Iran Escalations

Heightened U.S.-Iran conflicts—including threats of military action, naval deployments in the Middle East, and Iran’s vows of strong retaliation—have sparked a classic risk-off environment across global assets. Far from serving as a safe haven, Bitcoin has been treated as a high-beta liquidity play, leading to sharp sell-offs alongside gold, silver, and equity futures. Thin weekend and early-week volumes have magnified these moves, with the uncertainty contributing to broader deleveraging. - Cascading Forced Liquidations and Liquidity Grab

Bitcoin has swept a major long-liquidity zone after price dipped to the $74,000 level, triggering widespread liquidations of leveraged long positions. Data indicates that long traders were largely flushed out, easing downside pressure and potentially resetting market structure for the next directional move. - Hawkish Federal Reserve Outlook Tied to Kevin Warsh Nomination

President Donald Trump’s nomination of Kevin Warsh—a former Fed governor known for his hawkish stance on monetary policy—to replace Jerome Powell as Fed Chair has rattled risk markets. Warsh’s focus on monetary discipline, criticism of excessive quantitative easing, and preference for reduced liquidity have raised fears of tighter conditions ahead. This has boosted the U.S. dollar and pressured risk assets like crypto, which perform best in low-rate, high-liquidity regimes. Expectations for fewer or delayed rate cuts have further eroded confidence. - Broader Macro and Sentiment Pressures

- Persistent ETF outflows and waning institutional demand have stripped away key buying support.

- The market’s inability to capitalize on earlier bullish catalysts has fostered a “crisis of confidence,” with low liquidity making any dip more violent.

- Cross-asset correlations remain high, as crypto moves in tandem with equities and commodities during risk-off phases.

Bitcoin has now shed substantial gains from its 2025 peak near $126,000 in October, down over 30-40% in recent months and testing levels unseen since mid-2025. Ethereum’s steeper losses reflect its higher sensitivity to altcoin weakness and broader market beta.

While current oversold readings and potential exhaustion in selling pressure could pave the way for a short-term relief bounce—particularly if macro headlines cool or dip-buyers defend key zones—analysts warn the larger downtrend persists until clearer catalysts emerge.

Traders should closely watch the critical $74,000 support level for Bitcoin. A sustained hold here could spark a near-term rebound and stabilize sentiment across the crypto market.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.