Date: Tue, Dec 30, 2025 | 06:20 AM GMT

As the year winds down, Pi Network (PI) continues to captivate the crypto community with its unique mobile-mining model and massive user base exceeding 60 million pioneers. Despite a rocky 2025 marked by its long-awaited mainnet launch in February and subsequent price volatility, speculation around a potential Binance listing refuses to fade. Wallet activity linked to Binance has reignited rumors in recent weeks, though no official confirmation has emerged from either side.

But if PI finally secures a spot on the world’s largest exchange, how high could its price climb? Let’s break it down based on market analysis, historical patterns, and expert forecasts.

Pi Network’s 2025 Journey: From Hype to Reality

Pi Network transitioned to its open mainnet on February 20, 2025, after years of development and KYC hurdles, unlocking real-world utility for its token. The launch sparked initial excitement, with PI surging to an all-time high near $3 in late February amid community-driven hype and listings on exchanges like OKX, Bitget, and BitMart. Trading volumes exploded, and a Binance community vote saw 86% approval for a potential listing.

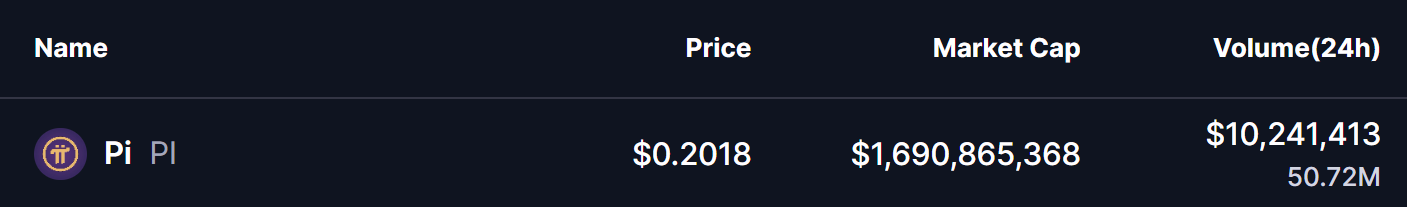

However, the post-launch reality brought corrections. Early sell-offs from miners and broader market downturns pushed PI down. As of today, PI trades around $0.20, with a market cap of approximately $1.7 billion and 24-hour volume over $10 million.

That’s a steep drop from its peak, but it reflects the challenges of a project emphasizing real-world adoption over speculative pumps.

Throughout the year, Pi expanded its ecosystem with features like fiat on-ramps via Banxa, domain auctions, and partnerships aimed at merchant integration. Yet, without a top-tier listing like Binance, liquidity remains limited, and price stability has been elusive.

The Binance Effect: Why It Matters

Binance listings are often transformative for altcoins, providing instant global exposure, enhanced liquidity, and credibility. For PI, with its grassroots origins and no ICO history, a Binance nod could validate its model and attract institutional interest. Past examples like Solana or Polygon show how such integrations can trigger 2-5x surges in the short term, driven by FOMO and increased trading pairs.

Pi’s community strength—over 70 million users across 200+ countries—makes it a prime candidate, but Binance prioritizes factors like stable liquidity, real use cases, and regulatory compliance over hype alone. Rumors have swirled all year, from February’s voting buzz to August wallet movements and December’s hot wallet activity, but denials from both teams persist. AI analyses even suggest a 2026 listing is uncertain without stronger fundamentals.

If it happens, experts anticipate a catalyst effect: broader adoption through Binance’s ecosystem, including futures and staking, could propel PI beyond its current constraints.

How High Can Pi Network (PI) Go if Binance List It?

Price projections vary depending on overall market conditions, but here’s the consensus view:

- Short-Term (1–2 Months Post-Listing):

Expect a strong initial surge driven by hype, retail inflows, and expanded trading. Most forecasts point to a rapid move back toward $0.75–$1, potentially delivering 3–4x gains from current levels. - Medium-Term (2–3 Months Post-Listing):

Following the initial pump, a healthy retracement is widely anticipated as profit-taking emerges and the market digests the surge. Prices could pull back 30–50% from post-listing peaks, stabilizing in the $0.45–$0.60 range while liquidity improves and ecosystem developments provide support.

Risks and Considerations

No prediction is foolproof. Pi faces hurdles like regulatory risks (e.g., scam allegations post-launch), competition from established chains, and potential sell pressure from early miners. Binance listings don’t guarantee sustained growth—many tokens pump and dump. Broader crypto trends, like Bitcoin’s performance or global regulations, will influence outcomes.

Investors should approach with caution: diversify, research Pi’s tokenomics, and avoid FOMO-driven decisions.

Final Thoughts

A Binance listing could be the spark Pi Network needs to reignite its momentum, potentially driving PI from its current $0.20 doldrums to near $1. With persistent rumors and a dedicated community, 2026 might finally deliver the breakthrough. For now, pioneers and watchers alike should monitor official channels closely—Pi’s story is far from over.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.