Date: Mon, Dec 08, 2025 | 05:20 AM GMT

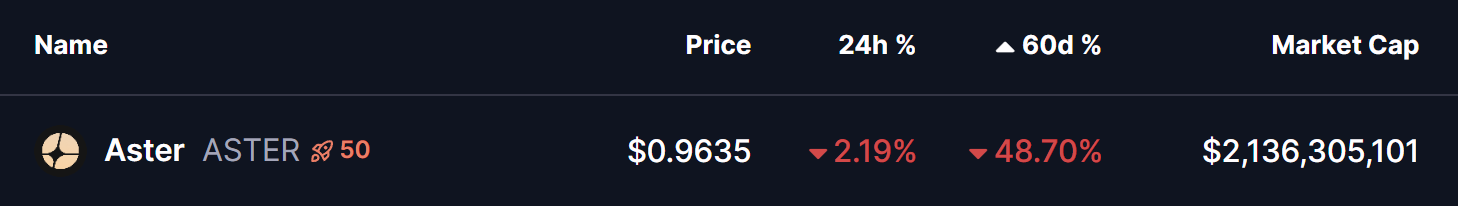

The broader altcoin market continues to struggle for momentum, and Aster (ASTER) has not been spared. The token has corrected by nearly 48% over the last 30 days, reflecting the wider market weakness. However, despite the price decline, the Aster team has continued to focus on strengthening long-term holder confidence through aggressive buyback strategies — and its latest announcement is a strong example of that effort.

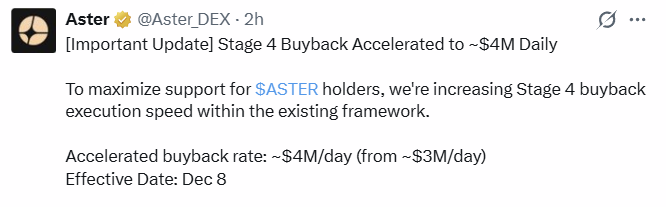

Aster Increases Daily Buybacks

In its latest update, Aster revealed a major enhancement to its Stage 4 buyback program, accelerating the pace of executions to provide faster and stronger support for token holders during volatile market conditions.

Starting December 8, the project increased its daily buyback execution rate from approximately $3 million to around $4 million per day. The goal behind this move is to push accumulated Stage 4 fees fully on-chain at a faster pace, helping stabilize price action while improving overall market confidence.

With this acceleration, the team expects to clear the backlog of fees collected since November 10 more efficiently. Based on current revenue levels, Aster estimates reaching a steady execution rhythm within 8 to 10 days. After that, daily buybacks are planned to continue at 60% to 90% of the previous day’s revenue until Stage 4 concludes.

All buyback transactions continue to be processed through the same verified wallet address:

0x573ca9FF6b7f164dfF513077850d5CD796006fF4

This ensures the entire process remains fully on-chain, transparent, and publicly verifiable.

Token Burns and Roadmap Progress Add Long-Term Confidence

The team’s commitment goes beyond just buybacks. On December 5, the official Aster buyback wallet burned 77.86 million $ASTER tokens (worth approximately $79.81 million), permanently removing nearly 1% of the total token supply from circulation — a move widely seen as a strong deflationary signal for long-term holders.

In addition, Aster’s recently published H1 2026 roadmap introduced several major developments. These include the planned mainnet launch of Aster Chain, a custom Layer-1 blockchain designed for sub-second finality and high-volume perpetual trading.

Outlook

While short-term price action remains fragile, Aster’s aggressive buyback expansion, token burn activity, and forward-looking roadmap highlight a strong focus on long-term ecosystem stability and growth. If broader market conditions improve, these efforts could serve as a strong foundation for future recovery.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.