Date: Thu, Oct 23, 2025 | 10:01 AM GMT

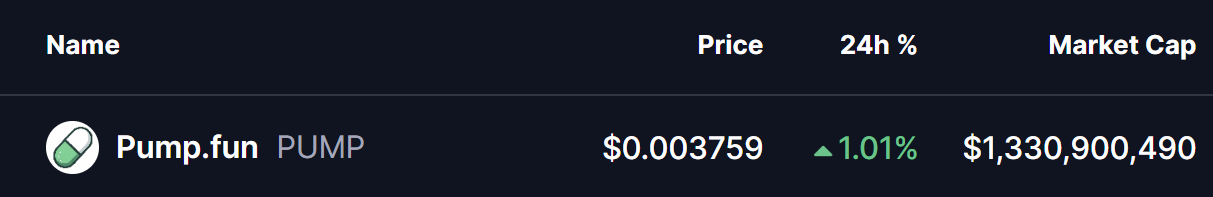

The broader cryptocurrency market continues to show an encouraging tone today, with Bitcoin (BTC) and Ethereum (ETH) both trading over 1% higher, setting the stage for potential upside in several altcoins — including Pump Fun (PUMP).

PUMP is back in green with modest intraday gains, and the latest chart setup suggests there might be more upside ahead. A developing harmonic pattern hints that a short-term bullish continuation could be underway.

Harmonic Pattern Hints at Potential Upside

On the 4-hour chart, PUMP appears to be forming a Bearish Butterfly harmonic pattern — a structure that, despite its name, often features a bullish rally during its final CD leg before reaching the completion zone.

The pattern initiated from Point X near $0.004566, followed by a sharp correction to Point A, then a rebound to Point B, and finally a dip to Point C around $0.003414. After establishing this low, PUMP has shown renewed strength and is currently trading around $0.003755, reflecting early signs of buying interest returning to the market.

Crucially, the token is hovering just below its 100-hour moving average (MA) at $0.004343, which acts as a key short-term resistance. A decisive breakout and close above this level could flip it into support — confirming the bullish continuation phase of the Butterfly pattern.

What’s Next for PUMP?

If bulls can sustain momentum above the 100-hour MA, the pattern projects a potential rally toward the Potential Reversal Zone (PRZ), located between $0.004935 and $0.005404. These levels align with the 1.272 and 1.618 Fibonacci extensions, both of which have historically marked completion zones for Butterfly patterns before a reversal phase begins.

However, failure to defend the C-level support at $0.003414 could invalidate the pattern, opening the door for a short-term pullback toward the $0.0031–$0.0030 range before any rebound attempt.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.