Date: Fri, April 18, 2025 | 05:28 AM GMT

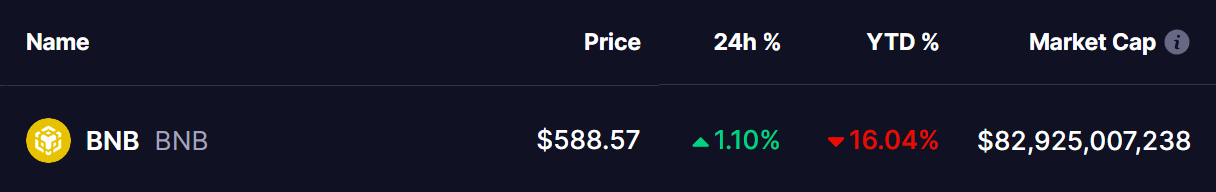

In 2025, the crypto market continues to feel the heat. Ethereum (ETH), which often leads overall market sentiment, posted a dismal first quarter, marking its worst start since 2018 with a shocking 45% drop. This negative momentum has also impacted major altcoins like Binance Coin (BNB), which has seen a 16% pullback so far this year.

But as the market attempts a recovery, BNB is now approaching a crucial level. The current formation on its weekly chart may decide the token’s fate for the next few months.

Is a Head and Shoulders Pattern in Play?

BNB is currently trading around $588, and a closer look at the weekly timeframe suggests the possible emergence of a head and shoulders pattern—a historically bearish structure.

This pattern started forming after BNB faced rejection at $728, leading to a sharp correction that marked the left shoulder. A strong rally of 51% followed, forming the head at $794. From there, the price sharply dropped by nearly 34.7%, bringing it back down to the neckline zone near $540–$570, where it found temporary support.

Now, BNB is attempting a rebound. If this structure continues to follow through, we could see a short-term rise back toward the $700–$730 level, completing the right shoulder. This would set up the potential for a final pullback to the neckline region and—if broken—confirm a bearish reversal.

What’s Ahead?

From a technical perspective, the MACD is still flat, reflecting indecisiveness and low momentum. The 50-week moving average near $602 is acting as resistance, while the 100-week MA around $458 could serve as a key support level if the neckline breaks.

If bulls can push price beyond the $728 zone with conviction, the entire bearish setup may be invalidated, and a larger rally could begin. However, failure to break that level—and especially a confirmed breakdown below the neckline—could trigger another sell-off, with price potentially targeting the $300 region.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.