Date: Thu, February 6, 2025 | 03:55 AM GMT

Despite Bitcoin (BTC) maintaining strong momentum, major memecoins and altcoins have been struggling to hold their ground. Since the November-December rally, many altcoins have undergone a steep correction, largely influenced by Ethereum’s (ETH) sluggish performance. ETH remains down over 29% in the last 60 days, failing to regain upside momentum.

Among the biggest declines is Ethereum’s top memecoin, Pepe (PEPE), which has faced a sharp 60% correction over the past two months. Currently, PEPE is trading around $0.000010 after hitting a three-month low.

Whale Accumulation

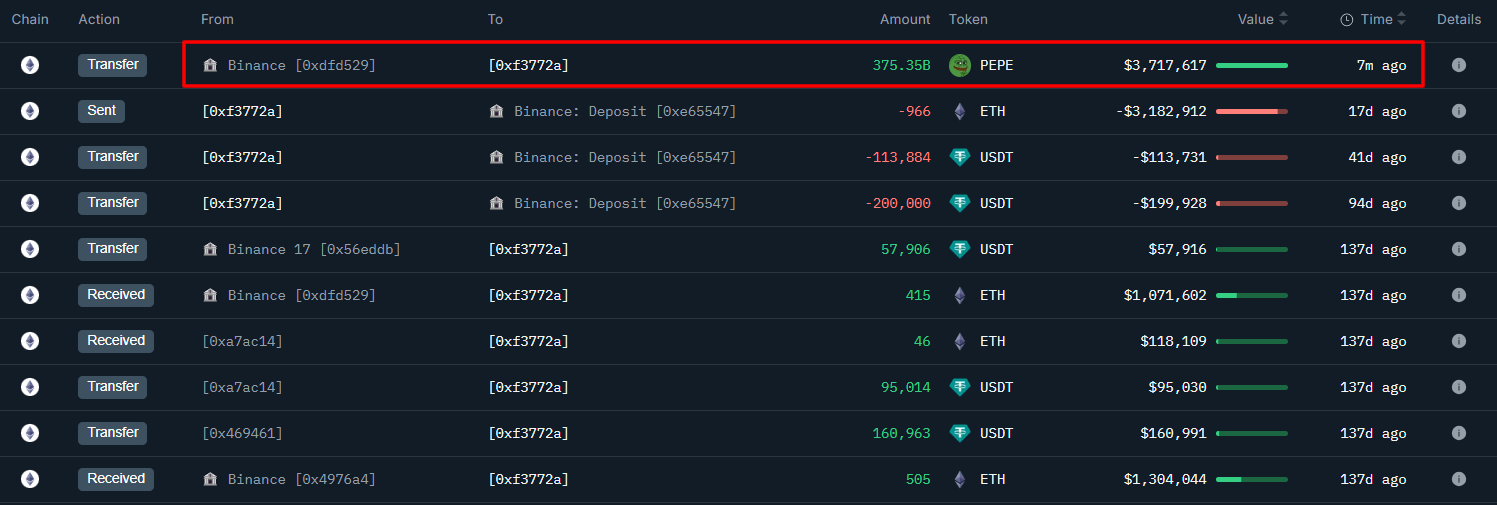

As PEPE reaches this critical dip, whale activity has started drawing attention. According to Onchain Lens, a whale withdrew 375.35 billion PEPE worth $3.71 million from Binance 11 hours ago.

This suggests that large investors are accumulating PEPE at lower levels, possibly anticipating a rebound.

Historical Pattern

According to crypto analyst Jameson, PEPE’s current price action on the 12-hour chart mirrors its performance from last year. Back then, the memecoin experienced a steep correction in December, followed by a failed breakout in January, and another dip in early February before rallying nearly 10x to March, jumping from $0.0000011 to a peak of $0.00001081.

With this historical fractal repeating, if Ethereum (ETH) recovers, PEPE could be primed for another explosive rally.

Final Thoughts

For traders watching memecoins, PEPE remains a key memecoin to monitor as the broader crypto market shows renewed strength. If history repeats itself, this dip might just be the perfect accumulation zone before a potential breakout.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before making investment decisions.