Date: Mon, Dec 23, 2024, 10:32 AM GMT

Before the ongoing correction last week, the cryptocurrency market had been on a bullish ride since November 5. This surge was fueled by Donald Trump’s victory in the U.S. elections, which propelled Bitcoin (BTC) to an all-time high of $108,000.

Following this, the top memecoin, Dogecoin (DOGE), also experienced a remarkable rally. DOGE jumped from $0.16 on November 5 to a recent high of $0.4798—a rally of nearly 200%. However, with the market undergoing a correction, DOGE has retraced 46%, dropping to a low of $0.2624.

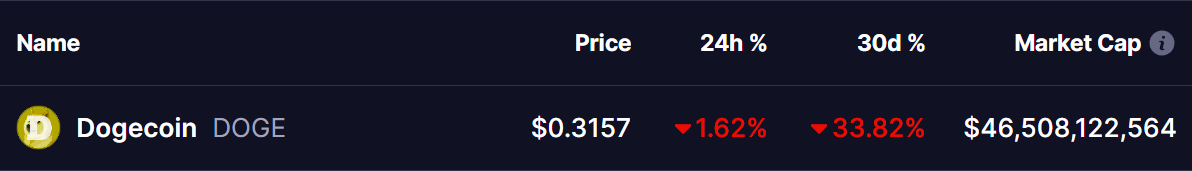

As of now, DOGE has rebounded slightly, trading at $0.3159, though it remains down 33% over the last 30 days.

Retracement Mirrors Past Bull Runs

The current DOGE price movement bears striking similarities to its previous parabolic cycles. According to crypto analyst @ali_charts, Dogecoin has shown a consistent pattern of significant rallies followed by corrections before surging to new heights:

- In 2017, DOGE surged 212%, retraced 40%, and then skyrocketed 5,000%.

- In 2021, DOGE rallied 476%, retraced 56%, and subsequently exploded by 12,000%.

Now, in 2024, DOGE has already rallied 440% and retraced 46%. If history repeats itself, analysts predict the potential for another massive parabolic rally

Based on @ali_charts’ analysis and the patterns observed in previous cycles, Dogecoin could climb to $20 during this bull run. However, this would require a significant increase in its market capitalization. With DOGE currently trading at $0.31 and a market cap of $46.55 billion, achieving this ambitious target would necessitate a massive influx of capital.

What to Expect Ahead?

With Dogecoin’s price retracing by 46% after a 440% rally, historical patterns suggest the possibility of a parabolic breakout ahead. If DOGE follows its previous cycles, such as those in 2017 and 2021, it could see another explosive rally in the coming months.

While the potential for significant gains exists, caution is advised. The cryptocurrency market is highly volatile, and retracements can deepen before a recovery materializes.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research before making any investment decisions.