Date: Sun, Dec 08, 2024, 10:36 AM GMT

The cryptocurrency market has been on a bullish rally over the last month, fueled by Bitcoin’s (BTC) impressive performance. BTC has surged by 31%, hitting a new all-time high of $103,900. This momentum has flowed into altcoins, with BTC dominance dropping to 55.22% from its recent high of 61.53%.

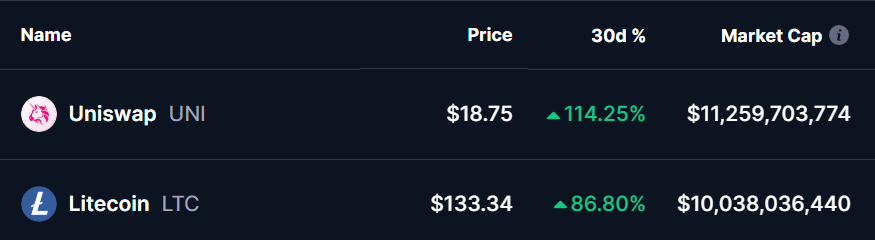

Two standout performers during this rally have been Uniswap (UNI) and Litecoin (LTC), which have surged by 114% and 86%, respectively, and are now approaching critical resistance levels.

Uniswap (UNI)

Uniswap (UNI) has seen a remarkable rally of 114% over the past month, surging from $9 to its current price of $18.72. This surge has pushed UNI into a critical resistance zone between $18.20 and $20.20.

If UNI manages to break above the $20.20 level, it could open the door for further upside, with the next major resistance levels at $23.06 and $28.30.

A successful breakout from this zone could translate to a potential 40% price increase from the current resistance point.

Litecoin (LTC):

Similarly, Litecoin (LTC) has also joined the bullish trend, posting an 86% gain in the past 30 days. LTC climbed from $70 to a recent high of $146 and is currently trading around $133.42. This places the token within a key resistance range of $128 to $146.

If Litecoin can break above $146, it could pave the way for a rally toward its next significant resistance level at $296, which would represent a 100% increase from the breakout point.

The MACD indicator for LTC reflects sustained bullish momentum, further supporting the potential for a breakout.

What To Expect Ahead?

Both Uniswap and Litecoin are displaying strong bullish trends, and their respective resistance zones are now within striking distance. With Bitcoin’s dominance continuing to decline, altcoins like UNI and LTC are in the spotlight, benefiting from increased market attention.

A successful breakout above their respective resistance levels could unlock substantial upside potential in the coming weeks. However, resistance areas are often tricky to navigate, and traders should wait for clear breakout confirmations with solid volume before making decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.