Date: Wed, Nov 13, 2024, 05:52 AM GMT

In the cryptocurrency market today, Bitcoin (BTC) has experienced a minor correction after reaching a new all-time high of $89,956.8 following Donald Trump’s recent victory in the EU elections on Nov 05. After its impressive rally, Bitcoin is now trading at $86,800, suggesting a healthy consolidation phase.

Despite this, two major altcoins—Stellar (XLM) and Hedera (HBAR)—have sustained bullish momentum due to notable developments in their respective ecosystems.

Stellar (XLM):

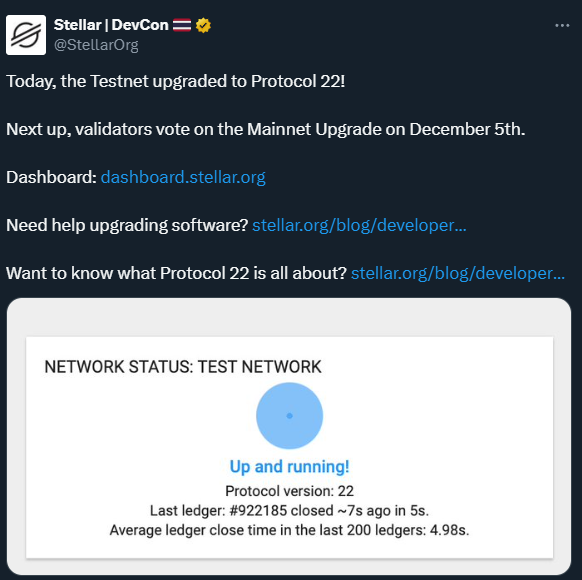

Stellar (XLM) has recently seen a price surge, coinciding with the successful testing of Protocol 22. The Stellar testnet has now been upgraded to this protocol, and the community will vote on Dec 5 for a mainnet upgrade, which could mark a new era for XLM. Additionally, stable software builds are expected to roll out on Nov 19, a move that should provide more stability and confidence to developers and investors alike.

What’s Ahead for XLM:

Stellar (XLM) is currently trading at $0.1256, with its recent move above the breakout level of $0.1078 signaling a potential trend shift. It now eyes a key resistance at $0.1587, a level that offers a 25% upside from the current price. On the support side, $0.1078, the previous breakout point, could serve as a solid base if the price encounters any downward pressure. Technically, XLM has broken out of a descending triangle pattern, which often signifies a reversal from bearish to bullish momentum.

The RSI is around 64, indicating strong buying interest but still short of overbought levels, suggesting room for further gains. With the upcoming vote on the mainnet upgrade and the recent successful completion of Protocol 22 testing, XLM appears well-positioned to target the $0.1587 resistance level in the short term if bullish momentum continues.

Hedera (HBAR):

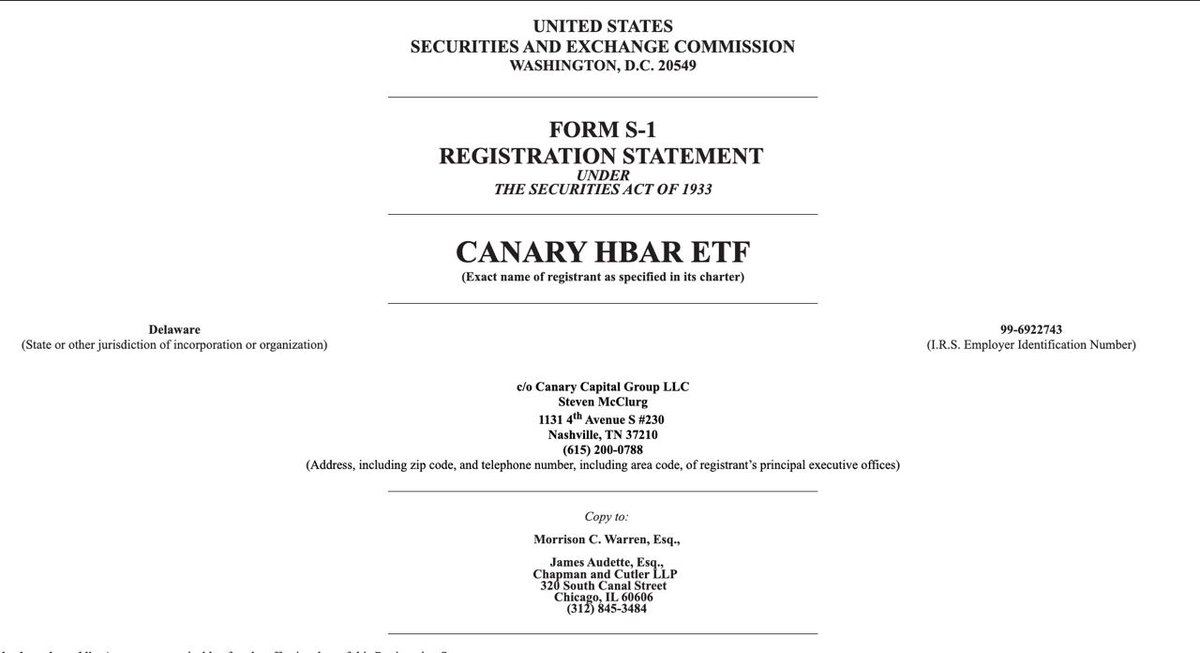

Hedera (HBAR) is rallying on the back of an announcement that Canary Capital has filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC) for an HBAR exchange-traded fund (ETF). If approved, this ETF would allow investors a more accessible way to gain exposure to HBAR’s price, potentially boosting demand and visibility for the asset.

What’s Ahead for HBAR:

Hedera (HBAR) is currently priced at $0.05778, having recently surpassed a breakout level of $0.04775, indicating a strong technical breakout. It faces potential resistance at $0.06362 and $0.07986, with a move to the latter representing a potential 38% gain from the current price. On the downside, support is seen at $0.05493, which could provide a cushion if prices pull back. From a technical standpoint, HBAR has broken out of a descending wedge pattern, a classic signal of a shift from a downtrend to an uptrend.

The RSI stands at 69, which is close to overbought territory, reflecting robust buying interest without yet signaling exhaustion. With continued positive sentiment, especially following the ETF news, HBAR could aim to test the $0.07986 resistance level in the near term.

Conclusion:

Both Stellar (XLM) and Hedera (HBAR) are demonstrating signs of technical breakouts alongside positive fundamental news, which may support their bullish trajectories. As both assets approach key resistance levels, traders will likely keep a close eye on further developments and potential breakouts to gauge the next phase of their upward movements.

Disclaimer: This article is for informational purposes only and is not financial advice. Always conduct your own research before investing in cryptocurrencies.