Date: Sat, Nov 09, 2024, 05:46 AM GMT

The crypto market is shining as Bitcoin (BTC) hit a new record high of $77,000, thanks in part to Donald Trump’s recent U.S. presidential election victory and his supportive stance on cryptocurrency. This surge has sparked a broader altcoin rally, with the Solana ecosystem reaping significant gains. Among Solana’s decentralized exchange (DEX) tokens, Raydium (RAY) has taken the spotlight, skyrocketing over 240% in the past month.

So, what’s fueling this massive run for Raydium?

Key Factors Behind Raydium’s Rise

1. Boost in DEX Trading Volume

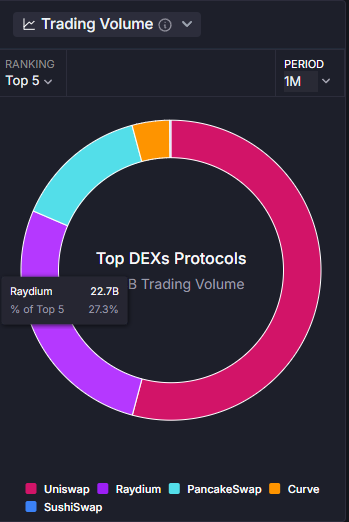

One of the primary drivers of Raydium’s impressive rally is the surge in DEX trading volume. According to Artemis, Raydium now holds the second spot in the top 10 DEX chains, boasting a trading volume of $22.7 billion and commanding 27.3% of the market share. While Uniswap still leads with $45.1 billion in volume, Raydium has solidified its position as a powerhouse in the decentralized exchange space.

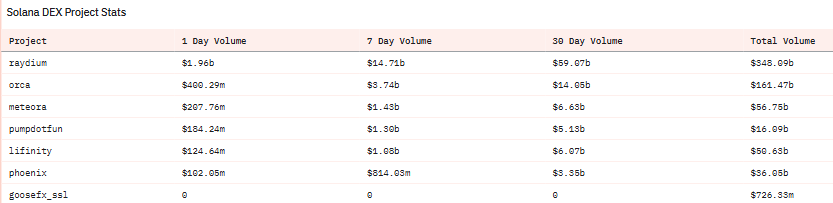

Within the Solana ecosystem specifically, Raydium is in a league of its own, capturing 62.8% of the DEX trading volume and surpassing the $59 billion mark over the past month. This dominance stems from Raydium’s appeal to memecoin traders, who are drawn by its ample liquidity and seamless trading experience.

2. Growth in Total Value Locked (TVL)

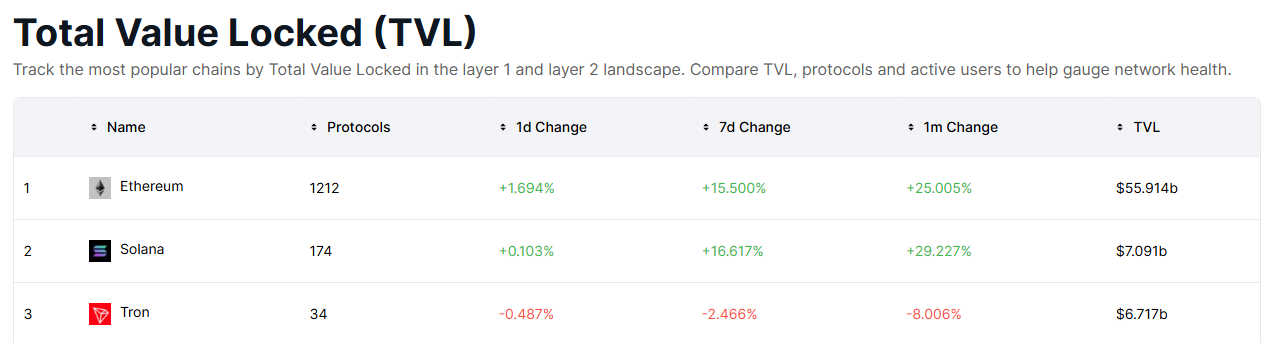

The Total Value Locked (TVL) on Solana has seen an impressive rebound, rising to $7.09 billion and placing it just behind Ethereum in the rankings. Solana’s TVL has surged by over 29% in the last 30 days, outpacing Ethereum’s growth during the same period.

Raydium has benefited significantly from this ecosystem-wide growth, as its TVL climbed from $128 million in early 2024 to an impressive $1.63 billion. This massive jump reflects the increased confidence of investors and traders in Raydium’s role within the Solana ecosystem.

3. PumpFun Partnership and Liquidity Boost

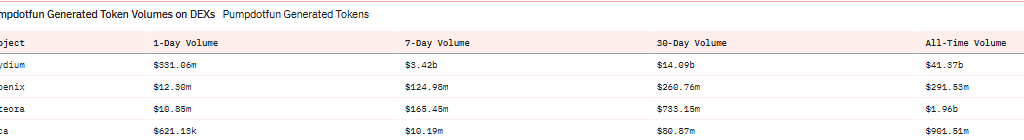

A notable factor behind Raydium’s surge in popularity is its integration with PumpFun, a launchpad for memecoins on Solana. Tokens launched on PumpFun automatically gain liquidity on Raydium once they meet a specific market cap threshold. This setup has turned Raydium into a hub for memecoin trading, as seen by its $14.99 billion trading volume on PumpFun according to Dune Analytics.

This liquidity pipeline has made Raydium the top choice for memecoin enthusiasts, securing its dominance in the space.

What’s Next for Raydium?

Looking ahead, Raydium seems well-positioned to maintain its lead in the Solana DEX ecosystem, especially as interest in decentralized trading and memecoins remains high. With Solana’s network gaining more traction and Raydium’s expanding liquidity options, traders and investors will likely continue to favor the platform. However, as with all crypto investments, market conditions can change quickly, so staying informed is crucial.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.