Date: Thu, Oct 24, 2024, 09:29 AM GMT

Bittensor (TAO), a leading AI token, recently saw a sharp correction after riding a significant rally. Following the broader crypto market’s decline, largely driven by Bitcoin’s (BTC) retracement from near $70K to below $67K, TAO’s price has dropped after hitting a peak of $683. The token is currently trading at $531, marking a 22% correction and erasing its monthly gains, now showing a 5% loss.

Analyst Weighs In: Two Potential Game Plans for TAO

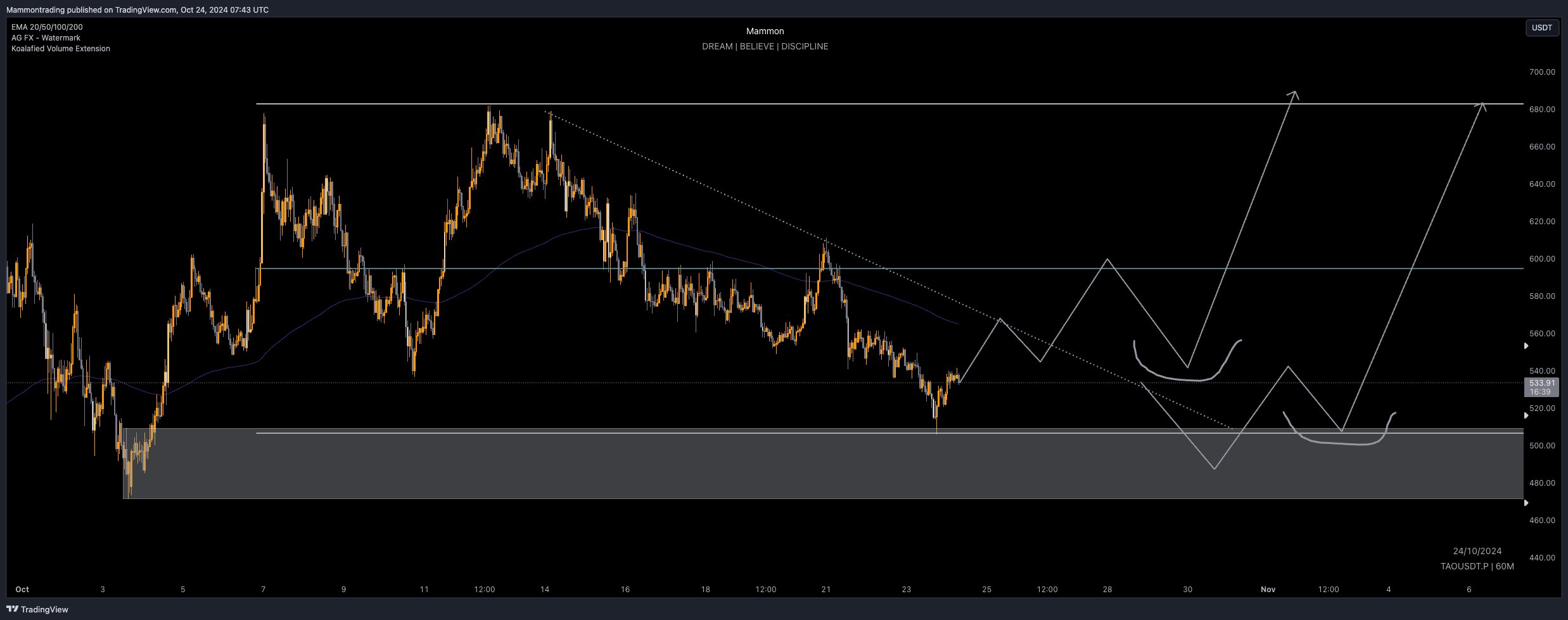

Crypto analyst @D_DTRADING shared his insights today, suggesting it’s time to closely watch TAO for a potential rebound. He pointed out that after this healthy 25% pullback, the token has landed in a strong demand zone on the 12-hour chart, also touching the 200 EMA on the 4-hour chart.

Here’s what he outlined as two possible scenarios ahead:

- Low is Already In: If TAO reclaims the 200 EMA and breaks the trendline, a higher-low formation could signal a bounce towards new highs.

- One More Dip: The second scenario is for TAO to make one more low into the demand zone before rebounding from the range low and targeting fresh highs.

However, the analyst advised waiting for confirmations before making any moves.

Open Interest Surge Suggests Growing Interest

Data from Coinglass shows that in the last 30 days, open interest (OI) in Bittensor (TAO) has surged from $144 million to $190.25 million.

This significant jump in OI indicates growing interest in TAO derivative contracts, suggesting traders are gaining confidence in its potential price movements. Such a surge in OI often points to strong market sentiment, signaling the possibility of bullish trends ahead. Increased liquidity and trading activity could provide excellent opportunities for traders eyeing TAO’s next move.

Conclusion

In conclusion, Bittensor ($TAO) is at a critical juncture after a 22% correction, presenting two potential paths forward. With strong demand zones in play and a surge in open interest, traders are closely monitoring for signs of a rebound. Whether TAO reclaims key levels or dips further before rising, the next moves could offer exciting opportunities for investors.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.