Date: Mon, Sept 16, 2024, 06:05 AM GMT

The cryptocurrency market is under pressure as traders and investors gear up for the upcoming Federal Open Market Committee (FOMC) meeting. The market opened the week with significant losses, with Bitcoin (BTC) dipping below $60,000 and currently trading at $58,525, marking a 2.78% decline for the day.

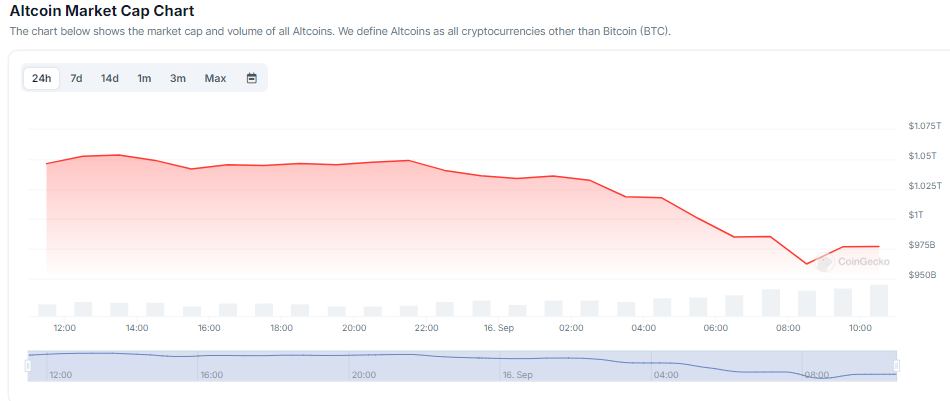

Altcoins Decline

It’s not just Bitcoin taking a hit. Altcoins that had performed well in recent weeks are also seeing substantial declines. Kaspa (KAS) and Fetch AI (FET) both fell over 4%, while Bittensor (TAO) experienced a sharper 9% drop.

This decline comes as market participants anticipate the FOMC meeting, scheduled for September 17-18. Investors are hoping for a potential interest rate cut by the Federal Reserve — the first in more than four years. Such a move would signal more favorable conditions for high-risk assets, like cryptocurrencies.

Why the Market is Dropping Despite Rate Cut Hopes

Although a rate cut is typically seen as a boost for riskier investments like crypto, the market is reacting to several factors driving short-term uncertainty:

- Lack of clarity: Investors are unsure about the scale of the expected rate cut. Without clear guidance on how large the reduction will be and the Fed’s future plans, many are selling off assets to reduce risk.

- Cautious sentiment: As is often the case before major policy announcements, markets are showing volatility. Traders are adopting a cautious stance, opting to sell early and lock in profits, a typical “buy the rumor, sell the news” behavior.

What’s Next?

Once the FOMC meeting wraps up and the Fed’s stance becomes clear, the market could see more stability. Should the rate cut meet or exceed expectations, Bitcoin and altcoins may enjoy some upside due to better financial conditions. Until then, the market is likely to remain choppy as uncertainty lingers.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.