Date: Sun, August 11, 2024, 09:08 AM GMT

The crypto market recently faced one of its biggest crashes of 2024, driven by a series of bearish reports. Ethereum (ETH), one of the market’s giants, saw its price plunge by a staggering 38%. However, the market has started to bounce back, with Ethereum now trading above $2,687 after hitting a low of $2,100 on August 5th.

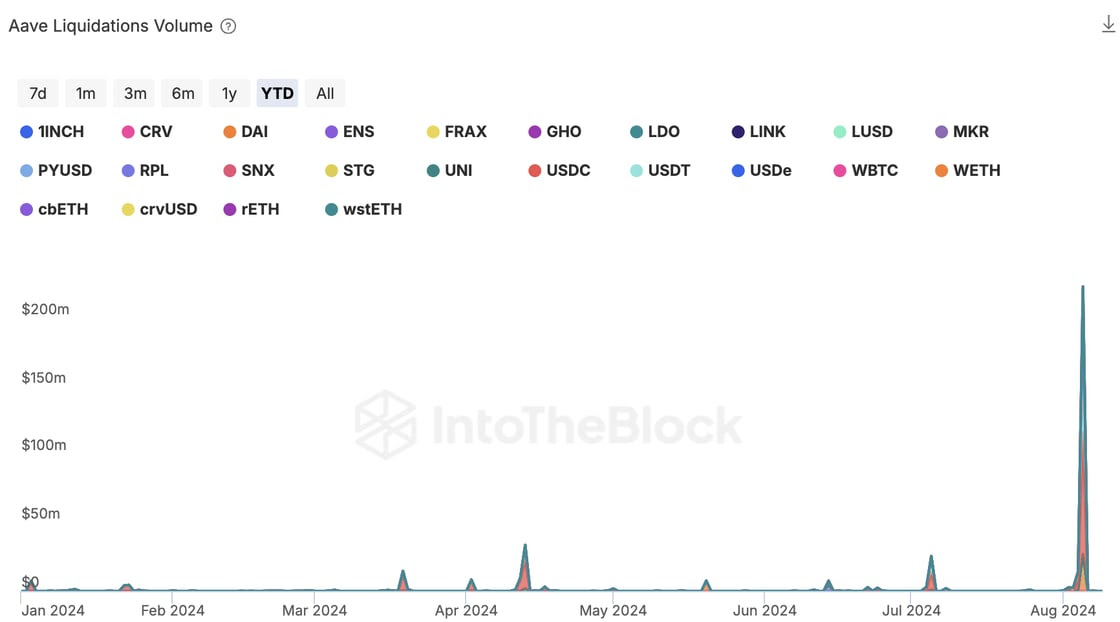

This sharp downturn had significant ripple effects across the market, particularly for Aave, a leading decentralized finance (DeFi) protocol. According to data from IntoTheBlock, Aave witnessed its largest-ever liquidation event this past week, with nearly $300 million worth of assets being liquidated. The primary cause was a 25% drop in Ethereum’s price, which heavily impacted stablecoin loans that were collateralized by wrapped staked Ethereum (wstETH).

Despite the massive liquidations, the Aave decentralized autonomous organization (DAO) managed to turn a profit, earning $6 million from the event. This liquidation marks a historic moment for Aave and underscores the volatility and risks inherent in the crypto market, especially during periods of intense market turbulence.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial advice.