(Tuesday 09 July 2024, 07:57 AM GMT):

Matthew Sigel, head of digital asset research at VanEck, forecasts a massive $6 trillion influx into the cryptocurrency market over the next two decades. This bold prediction stems from a 2024 research report by a US bank’s private banking division, projecting a significant generational wealth transfer.

The report indicates that by 2045, Generation X, millennials, and future generations are set to inherit $84 trillion from older generations, including baby boomers. Sigel highlights that for $6 trillion to flow into cryptocurrency, young Americans aged 21 to 43 would need to inherit $42 trillion and consistently channel 14% of these funds into crypto investments.

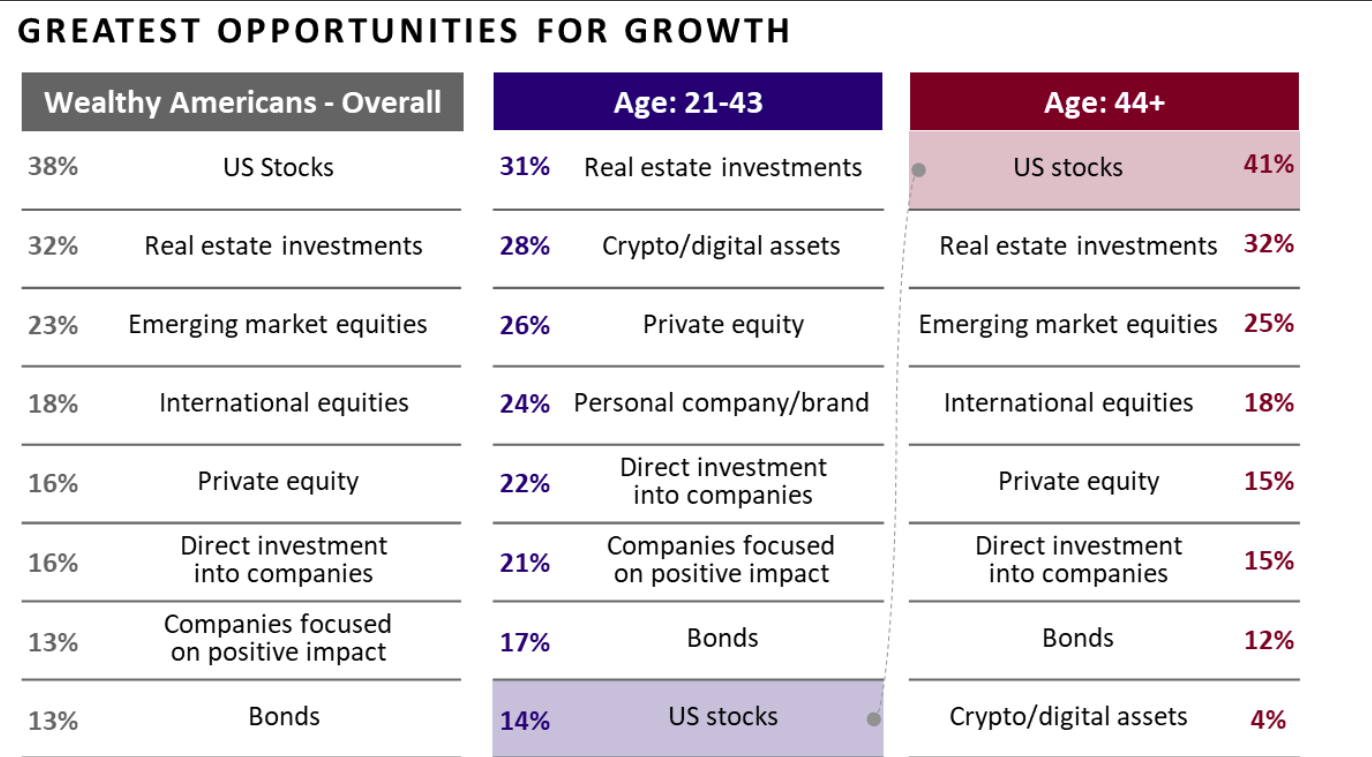

This ambitious goal translates to young investors injecting $300 billion annually into the cryptocurrency market over the next 20 years. The research underscores that aggressive young investors typically allocate 14% of their portfolios to cryptocurrencies. Interestingly, even the most conservative young investors dedicate 12% to 17% of their funds to crypto, showing a broad interest in digital assets among this age group. In stark contrast, older investors, those aged 44 and above, show minimal interest in cryptocurrencies, with negligible allocations in their portfolios.

Additionally, the study reveals that 28% of investors aged 21 to 43 see the most growth potential in cryptocurrency, making it their second favorite investment after real estate (31%) and just ahead of private equity (26%).

Sigel’s prediction underscores a shifting investment landscape where younger generations, inheriting vast wealth, could significantly bolster the cryptocurrency market. This trend reflects growing confidence in digital assets as a viable long-term investment.