Date: Mon, Dec 30, 2024, 06:17 AM GMT

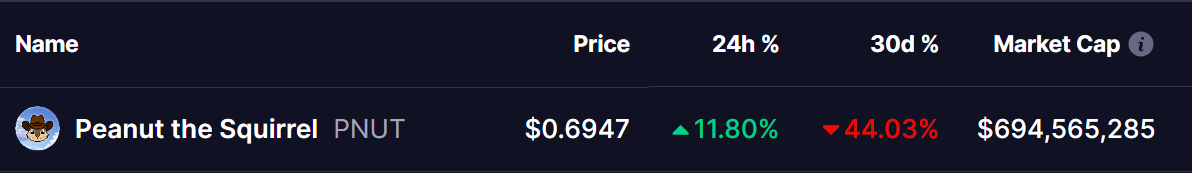

In the cryptocurrency market today, Peanut the Squirrel (PNUT), the meme coin that grabbed major headlines in early November, is back in the spotlight. After an impressive 10% surge, PNUT is showing signs of a potential reversal from its recent correction phase.

Whale Accumulation:

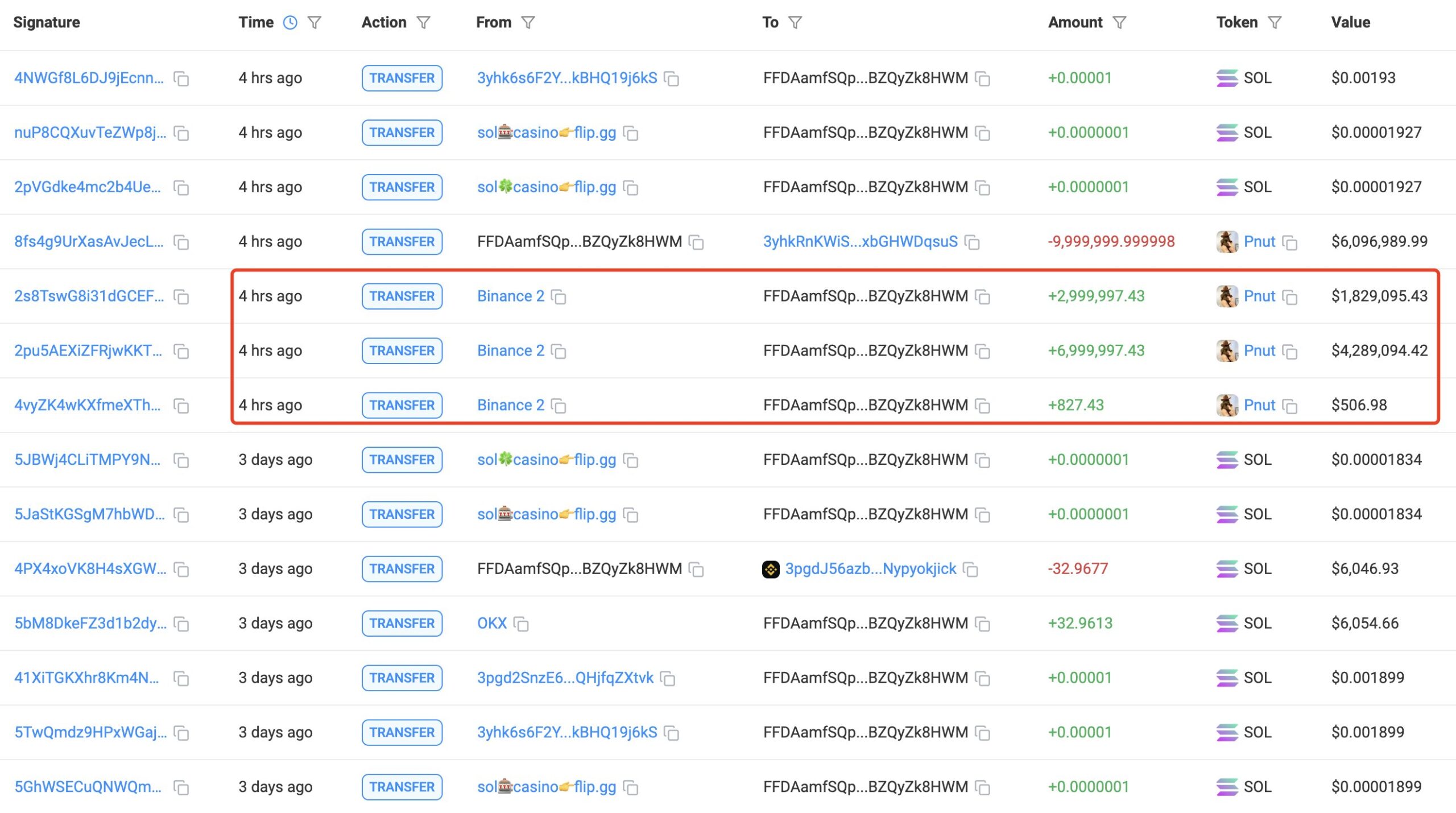

Since PNUT’s sharp correction from its all-time high of $2.50, bringing it down to the current price of $0.70, whale activity has intensified. According to today’s report from Lookonchain, a whale withdrew 10 million PNUT ($6.1 million, or 1% of the total supply) from Binance just 8 hours ago.

This accumulation at such low levels could indicate growing confidence in PNUT’s future rally, particularly among high-net-worth investors.

Gears Up for Major Breakout:

In early November, PNUT delivered a staggering rally of over 800% within weeks, driven by hype and indirect tweets from major celebrities. However, after hitting its all-time high of $2.50 on November 14, PNUT underwent a steep correction of over 75%, bottoming out at $0.59 and entering a descending triangle pattern on the charts.

Today’s rally has brought PNUT’s price to $0.69, nearing the descending triangle’s resistance line. A breakout above this level could confirm a bullish reversal. If PNUT manages to sustain momentum and break past the critical resistance of $0.80, it could ignite a fresh leg upward, targeting key resistance levels at $1.58 and its previous high of $2.50.

Technical Indicators:

- RSI (Relative Strength Index): Currently sitting at 39.18, the RSI indicates PNUT is recovering from oversold conditions. A move above 40 could signify strengthening bullish momentum.

- MACD (Moving Average Convergence Divergence): The MACD histogram shows a decrease in bearish momentum, with the signal line inching closer to a bullish crossover. This alignment supports the possibility of a trend reversal.

What’s Next?

While PNUT’s short-term price action is encouraging, traders should monitor the $0.80 resistance level closely. A breakout with high trading volume could confirm the start of a new uptrend, potentially bringing PNUT back into its hype-driven rally mode. However, failure to break this level might result in continued consolidation or a retest of lower support levels around $0.59.

As whale accumulation increases and momentum builds, PNUT’s future price action will depend heavily on market sentiment and macroeconomic conditions. Investors are advised to stay cautious and follow proper risk management strategies.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.