Date: Mon, May 19, 2025 | 07:25 PM GMT

After mounting a solid comeback in recent weeks where Ethereum (ETH) climbed to $2,700, the crypto market has once again entered turbulent waters, with ETH now pulling back toward the $2,500 mark, and this wave of volatility is rippling across major altcoins.

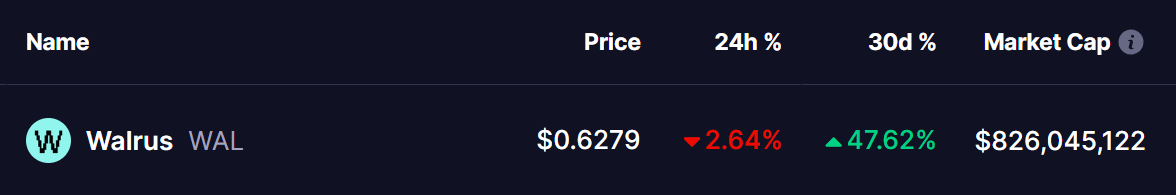

Walrus (WAL), one of the notable performers in recent weeks, is also experiencing pressure. After trimming its monthly gains to over 47%, a closer look at its chart reveals a promising setup that may hint at a much bigger move ahead.

WAL Mirrors SOLAYER’s Breakout Setup

In the chart above, the left panel showcases Solayer (LAYER) on the daily timeframe. Back in March, LAYER broke out from a well-defined ascending triangle pattern, flipping a key horizontal resistance around $1.01 into support. After a brief retest, the price exploded by more than 228%, topping out around $3.33 before pulling back.

Now, look at the right panel — this is Walrus (WAL). The structure is strikingly similar.

WAL has also formed an ascending triangle, recently breaking out above its horizontal resistance zone near $0.62. It made a quick move up to a local high of $0.77, followed by a classic retest of the breakout zone — just like LAYER did before its massive rally.

What’s Next for WAL?

If WAL continues to hold above the $0.60–$0.62 support range, history could repeat itself.

If the fractal plays out, WAL could surge toward the $1.80–$1.90 range, mirroring LAYER’s 200%+ rally. This would represent a significant upside and could mark the beginning of a strong bullish trend — especially if confidence returns to the broader market.

However, traders should keep a close eye on ETH’s next move. As ETH controls much of the market sentiment, its recovery (or lack thereof) could heavily influence WAL’s ability to push higher.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before making investment decisions in cryptocurrencies.